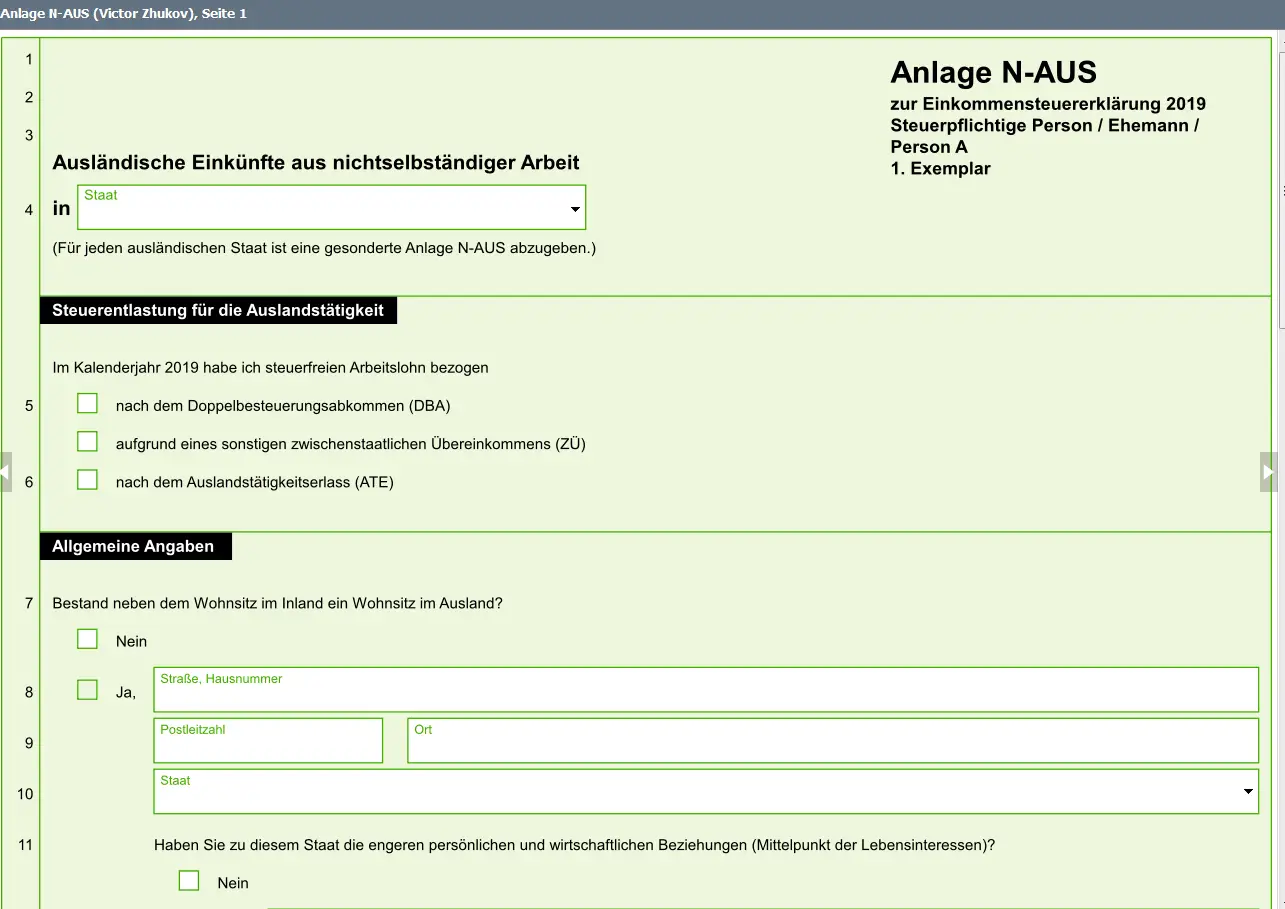

Are you renting (buying) a second home to spend the night closer to work? This will be called Doppelte Haushaltsführung. There are a number of deductible expenses for second home in Gerrman tax return. Let’s take a closer look at how this is done using the example of an employee. An individual Self-employed can also rent a second home (and write them off as Betriebsausgaben). The principles of deduction will be the same.

It also makes sense to review the rules and restrictions for those who are just thinking about whether or not to take such a job that you will have to rent a second home.