Last Updated on September 27, 2023

Filling out Anlage EÜR was not so easy. I once thought that Anlage EÜR is a simple piece of paper with two columns: “Income” and “Expense”. It turned out that this is such a concentrated declaration, where much of what is in a regular declaration is repeated, only in relation to entrepreneurs. Anlage EÜR even has its own applications.

But despite its formidable size, filling out the Anlage EÜR is always presented as the biggest advantage for small entrepreneurs – compared to the dreaded and scary accounting.

All I can return from tax: A-D, E-H, I-N, P-W

Anlage N Part 1, Part 2, Anlage N-Aus, Anlage Wa-Est, Homeoffice

Anlage Kind

Anlage Vorsorgeaufwand

Anlage Sonderausgaben

Anlage Haushaltnahe Diensleistungen 35a

Who should file a tax return in Germany

Pre-filled declaration in Elster

How to calculate tax in Germany. What is written in Berechnung in Elster

Freiberufler in Germany: how to fill in Anlage S and Fragebogen zur steuerlichen Erfassung

Note. I am not a tax consultant and am not responsible for the content of your declaration.

Who must fill out Anlage EÜR

EÜR – in full form Einnahmenüberschussrechnung, that is, the calculation of the amount of profit by how much income exceeds expenses.

Anlage EÜR must be filled out by both “free” entrepreneurs Freiberufler and less free small entrepreneurs who are not subject to mandatory accounting.

Those whose profit is less than 22,000 thousand euros per year (previously 17,500 per year) are exempted from paying Umsatzsteuer (tax like (not equal) value-added tax). This is called the small business rule (Kleinunternehmerregelung).

This analysis is focused primarily on small entrepreneurs – those who rent an apartment, have solar panels, are engaged in a small business without employees and significant capital, Freiberufler. Therefore, I will not describe the difficult points for larger entrepreneurs in detail. They have definitely own tax consultants for these questions.

Free from filling out the Anlage EÜR are only those who have worked ehrenamtlich and whose income does not exceed

Übungsleiterfreibetrag – 3000 euros (until 2020 – 2.400 euros)

or Ehrenamtspauschale – 840 euros (until 2020 – 720 euros)

Although the form is called an application, Anlage EÜR, it exists as a separate form. It must be additionally selected in Elster in the forms, fill out the introduction with general data again.

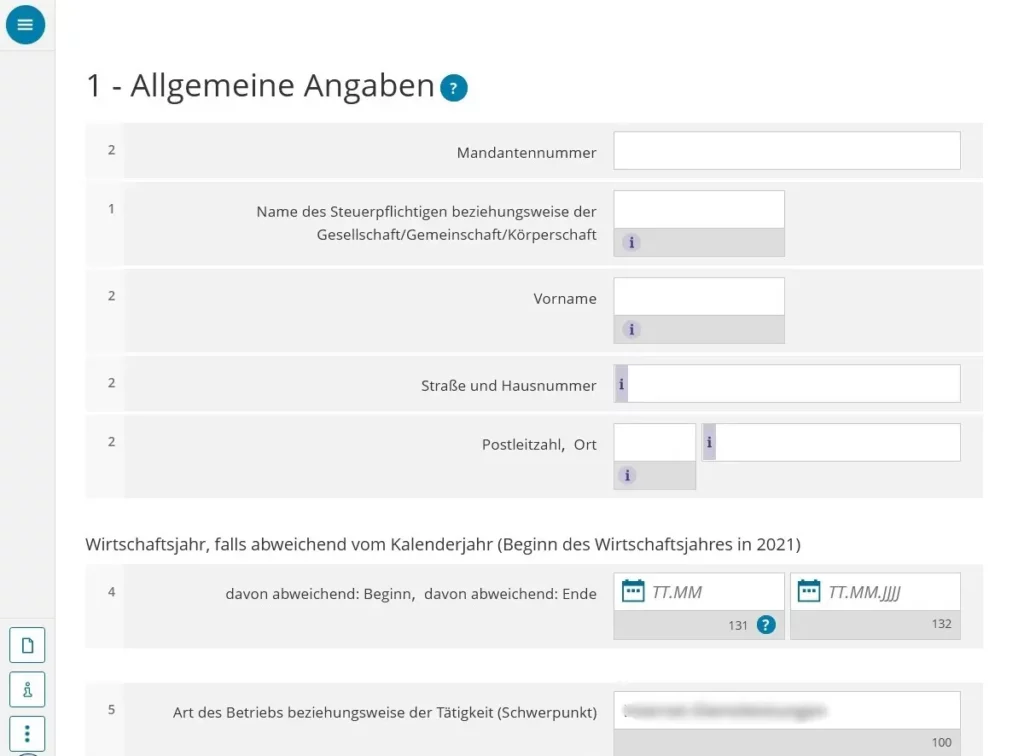

Completing Anlage EÜR – part 1, general information

Everything is clear here:

Lines 1-2 the name of the person or the name of the organization, address.

Line 3 with tax number filled in as soon as you opened this application

Line 4 – other dates of the organization’s accounting year – abweichendes Wirtschaftsjahr. This reporting period is first agreed with the Finanzamt (FA). If you started work in the reporting year, then they talk about Rumpfwirtschaftsjahr, and this is a different concept. Forestry and agricultural organizations always have a different accounting year, the rest must be coordinated with the FA.

In the case of starting activities not from the beginning of the year, write the date of commencement of the activity, in case of completion not in the end of the year – the date of completion of the activity.

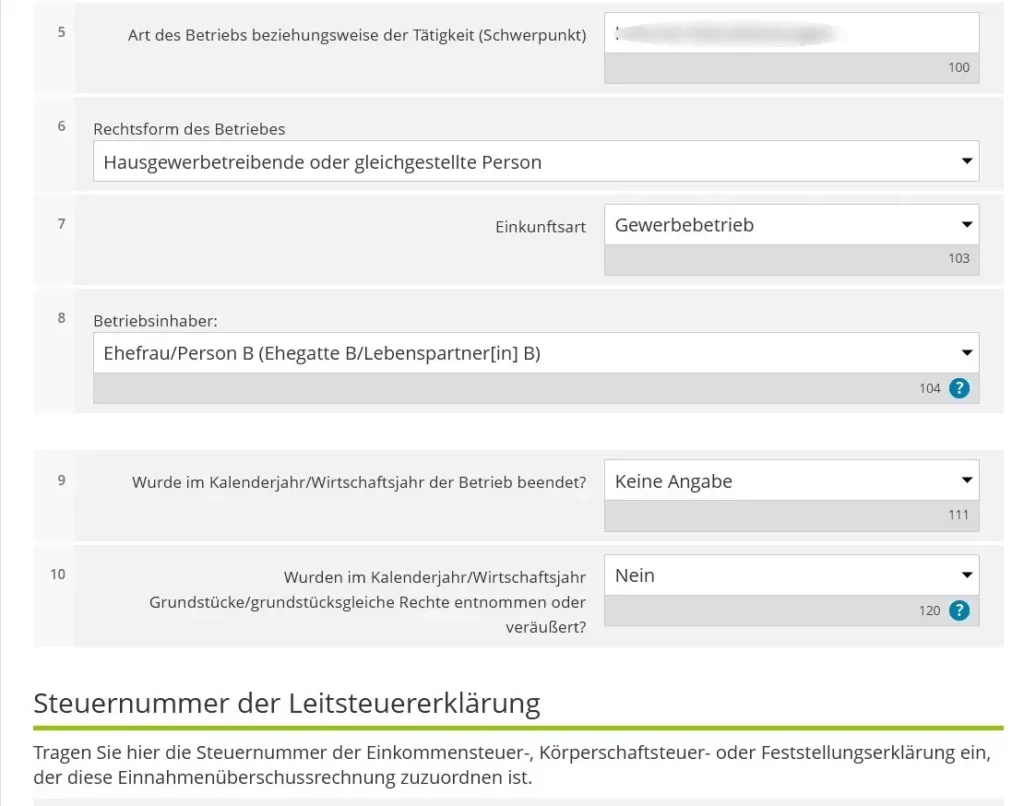

Line 5 – your type of activity that you declared when you registered your enterprise.

Line 6 – in what legal form you operate. For a self-employed person working from home, this would be Hausgewerbetreibende

Line 7 – where we get our income from. Those who have Gewerbe get them naturally from Gewerbe. Those who are freiberuflich – from selbstständiger Arbeit.

Line 8 – you need to choose who does make this application from the two partners, if the declaration is joint.

Lines 9 and 10 – if you closed the business or sold the land belonging to it.

At the end, you need to enter the tax number from the declaration, to which we attach this application.

Paragraph 2 identifies the consultant who assisted with the completion, if any.

Income in Anlage EÜR

It is important that all income and expenses are paid in the year in which they were received / spent, regardless of which year they refer to. Exception: Regular expenses like rent that fall within 10 days of the previous or next year.

The company’s income includes, in particular:

income in the form of payment for goods or services

Umsatzsteuer

reimbursed Umsatzsteuer

income in kind

income when you use the property of the organization for personal purposes, but do not pay for it (for example, you registered the car as owned by the company, but also use it for personal purposes – this must be registered)

Corona-Hilfe is income too

Income may be subject to Umsatzsteuer, or may be exempt from it or may be not subject to this tax at all.

umsatzsteuerpflichtig, Umsatzsteuer payable is the payment for goods or services sold domestically, except for the following

umsatzsteuerfrei -exempt from Umsatzsteuer. If your income falls into this list or is similar to those on the list, double-check the details, because under different conditions, different options are possible.

interest charges,

amounts for rent (not all)

services of doctors and therapists, psychologists, midwives, nutrition consultants, hygienists, care services

services of representatives of insurance and intermediaries in concluding loans, Bausparkasse intermediaries

ehrenamtlich work for a public organization

art services: stage directors, choreographers (but not for individual directors and costume designers), performances from museums, theaters, concerts, choirs, actors, musicians, singers, etc. (but not selling CDs)

educational services of private schools (including distance learning, driving, tutoring for exam preparation, music lessons, dancing)

educational services of teachers working for public educational organizations (classes related to obtaining a specialty)

social services to help children and families

delivery abroad

lottery winnings

nicht umsatzsteuerbar (which do not fall under Umsatzsteuer due to the fact that the requirements are not fulfilled – these are not internal German services or these are not services or goods at all) are:

foreign income (including receiving money from services to foreign websites, such as from Google),

compensation for damages

insurance payments,

compensations,

fines (Mahnungen) and interest on the debt received,

government subsidies such as forestry subsidies, land consolidation subsidies or other subsidies

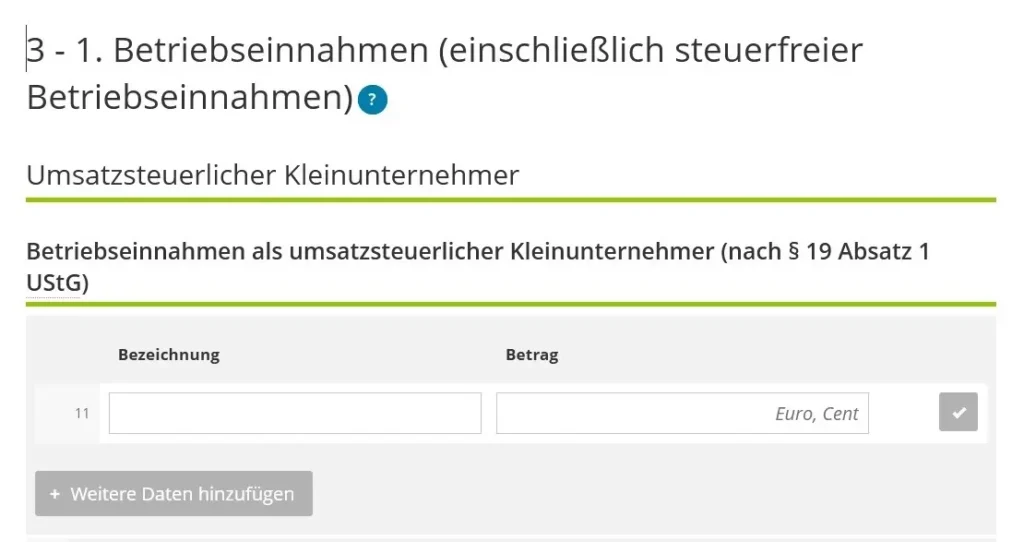

Line 11 – income of small businesses with an income of less than 22,000 euros. They don’t take Umsatzsteuer from their customers. Small businesses go further in line 18.

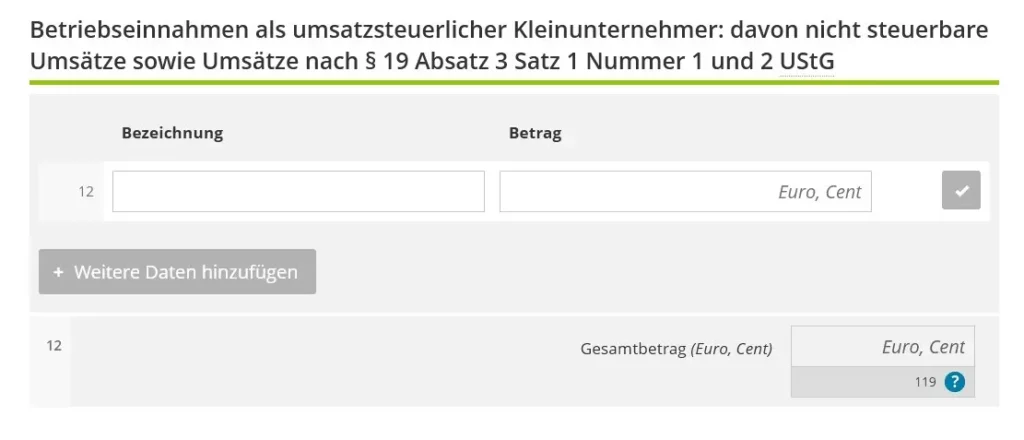

Line 12 – from these incomes, those that are not subject to taxation.

Line 13 – for forestry.

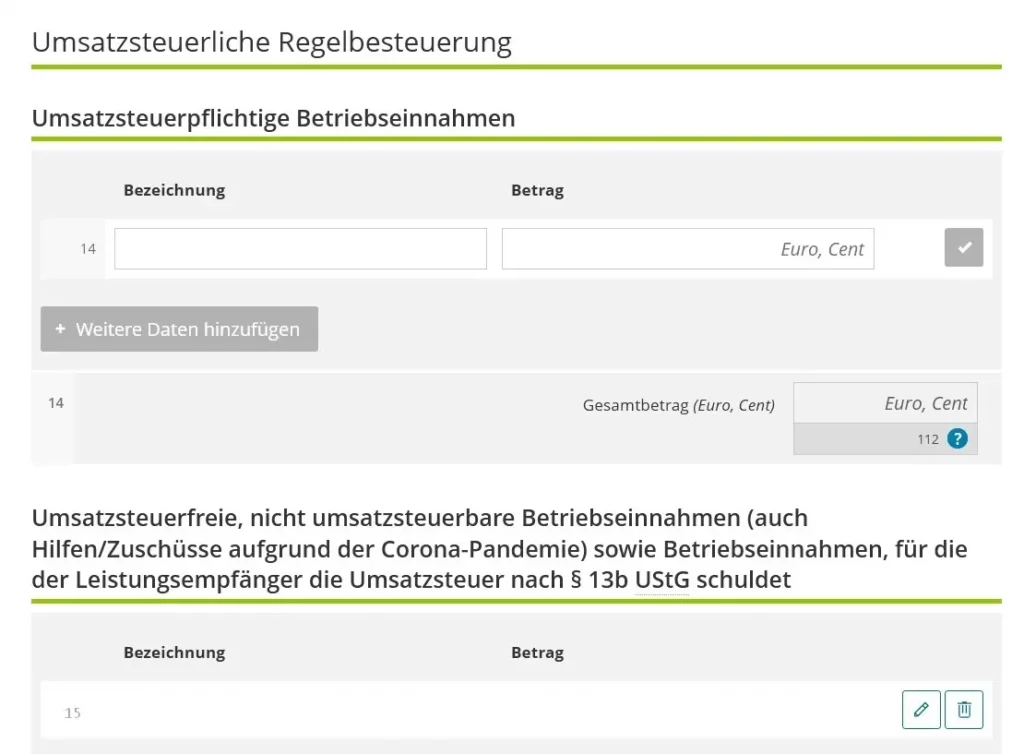

Line 14 – income of ordinary businesses not exempt from Umsatzsteuer. Line 15 – of these incomes, the part not payable Umsatzsteuer.

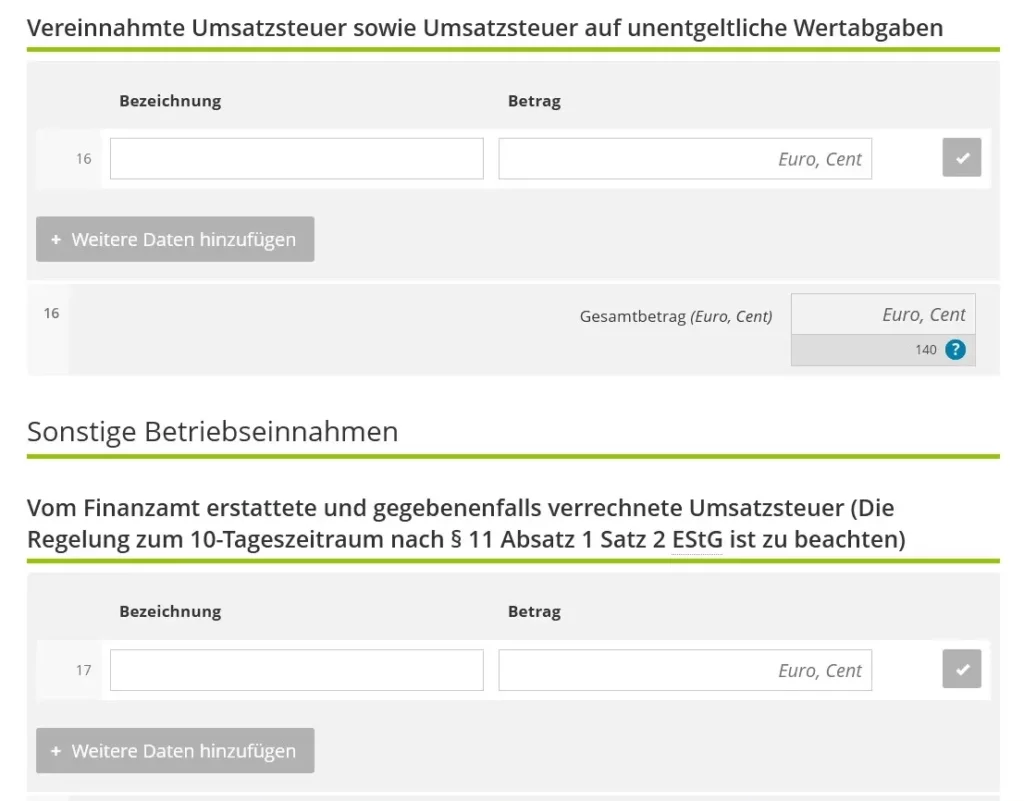

Line 16 -the tax you take from the client,

Line 17 – refundable tax from FA

Lines 18 to 20 may also apply to small entrepreneurs

Line 18 – for those who have sold machines or other actives

Line 19 – for those who used a car, that belongs to the business, for private purposes

Calculating the use of a company car is a separate big topic. In short, you can choose between real usage, which is confirmed by the trip log, and a lump-sum 1 percent rule. There are different calculators, but more often they are focused on employees. I found this for entrepreneurs: https://www.online-tools.biz/geschaeftswagen/index/e6eDBXTYBEyhiP4a

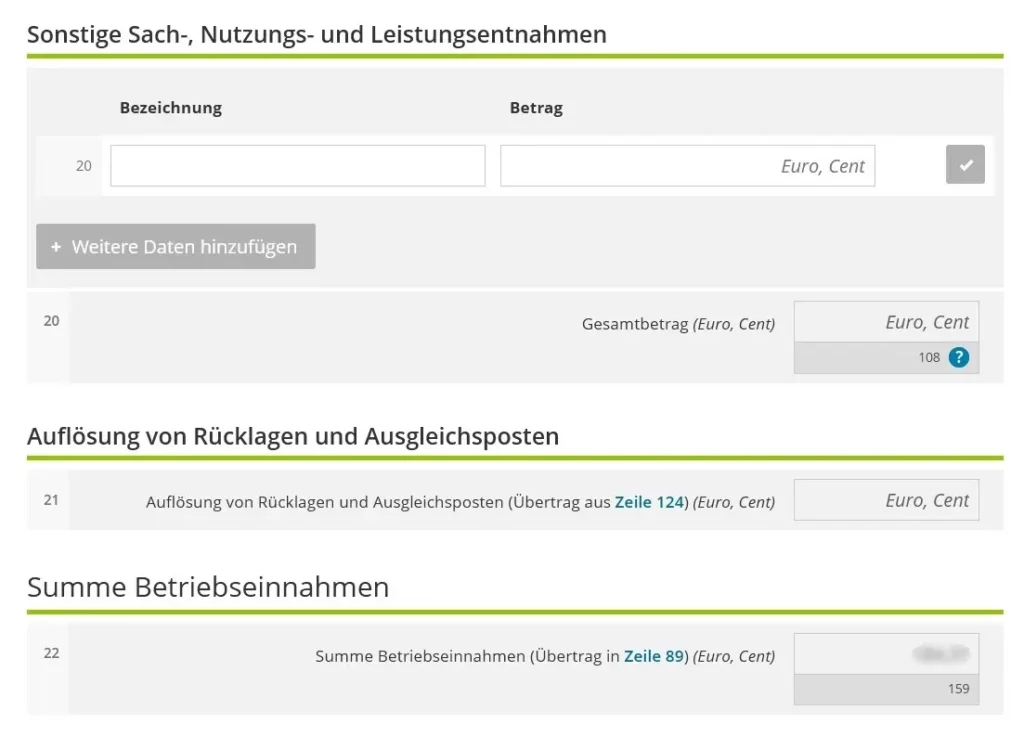

Line 20 – use for private purposes of other items belonging to the organization. For example, you are selling something and have taken part of the goods for your personal use. Or you used the services of your company for private purposes.

Line 21 is transferred from line 124 (this is about the assets of the company – in general, not for small entrepreneurs).

Line 22 – automatic calculation of income.

Expenses in Anlage EÜR

Now let’s dive into the expenses. As for income, the principle is important: in what year the money was spent – in that year we indicate.

Please note: the costs are shown netto – that is, without Umsatzsteuer. But! small businesses that do not pay Umsatzsteuer indicate the gross!

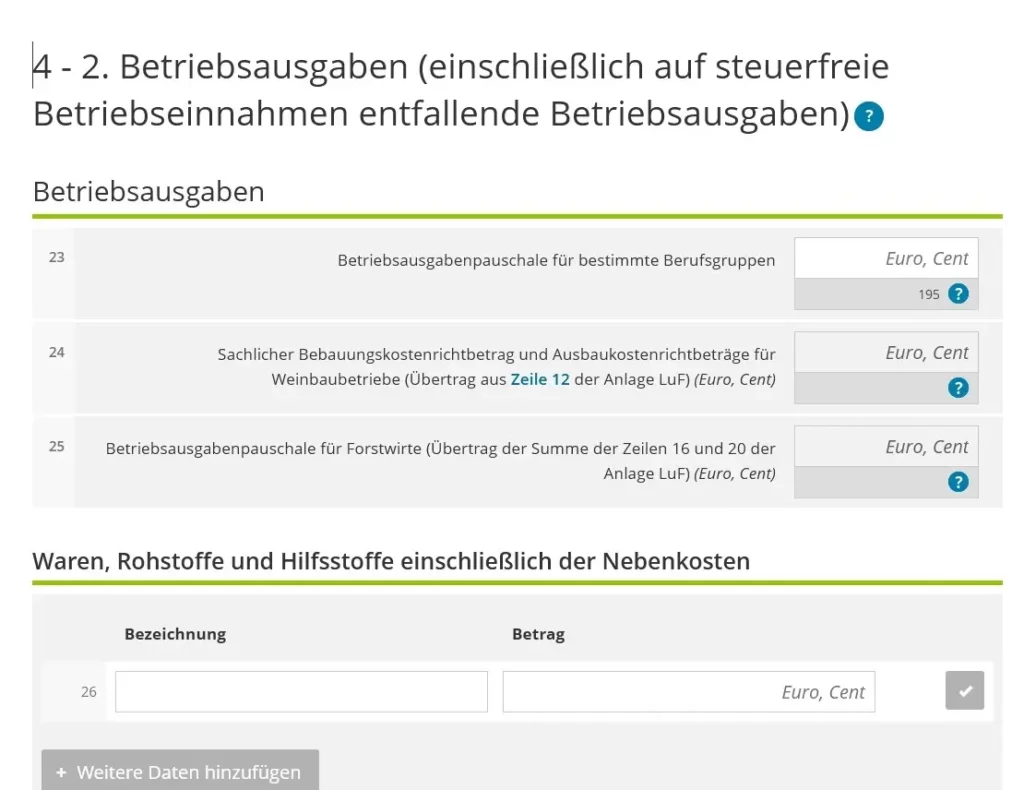

Line 23. Some professions have lump sums that they don’t have to prove. And this:

midwives – 25 % from income, but no more than 1535 euros per year

journalists and writers – 30% of income, but not more than 2455 euros per year

Tagesmutter, who does not use the free childcare space may deduct 300 euros per child for a full day of care (8 hours). If she looks after a smaller amount of time, then the paushal decreases accordingly.

working nebenberuflich in the educational, scientific or creative field can write off 25% of income, but not more than 614 euros

truck drivers from 2019 – 8 euros per day

If the real costs are higher, they must be proven.

Lines 24 and 25 for wineries and forestry.

Line 26 – if you buy materials and goods for your work. Here you need to specify their value.

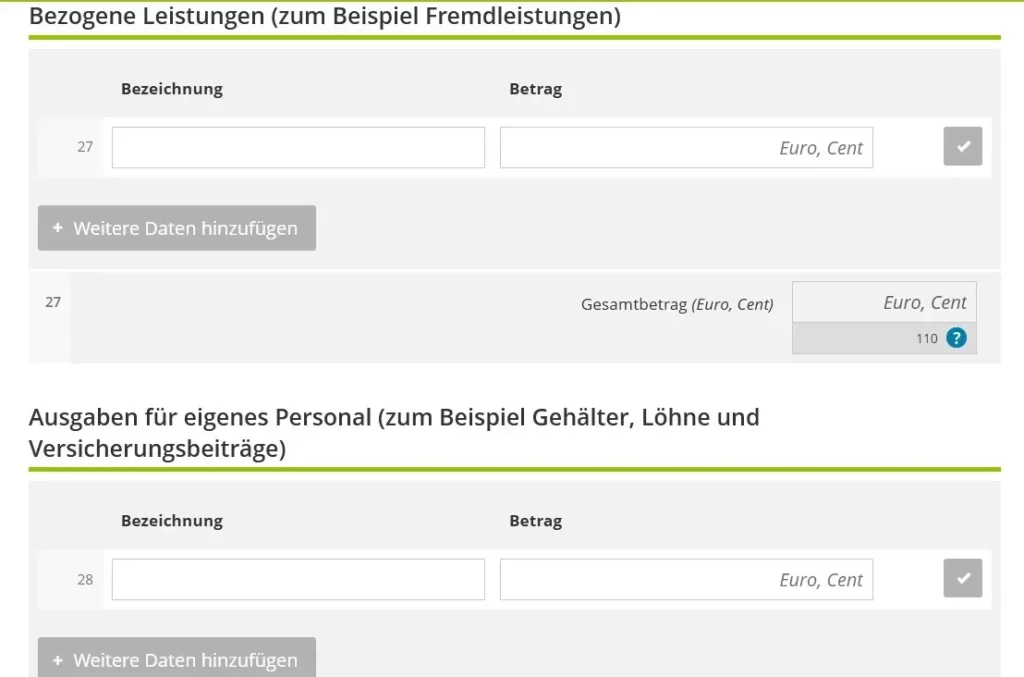

Line 27 – if you involve the services of third parties (make you a website, deliver goods, etc.).

Line 28 – staff costs, if you have one.

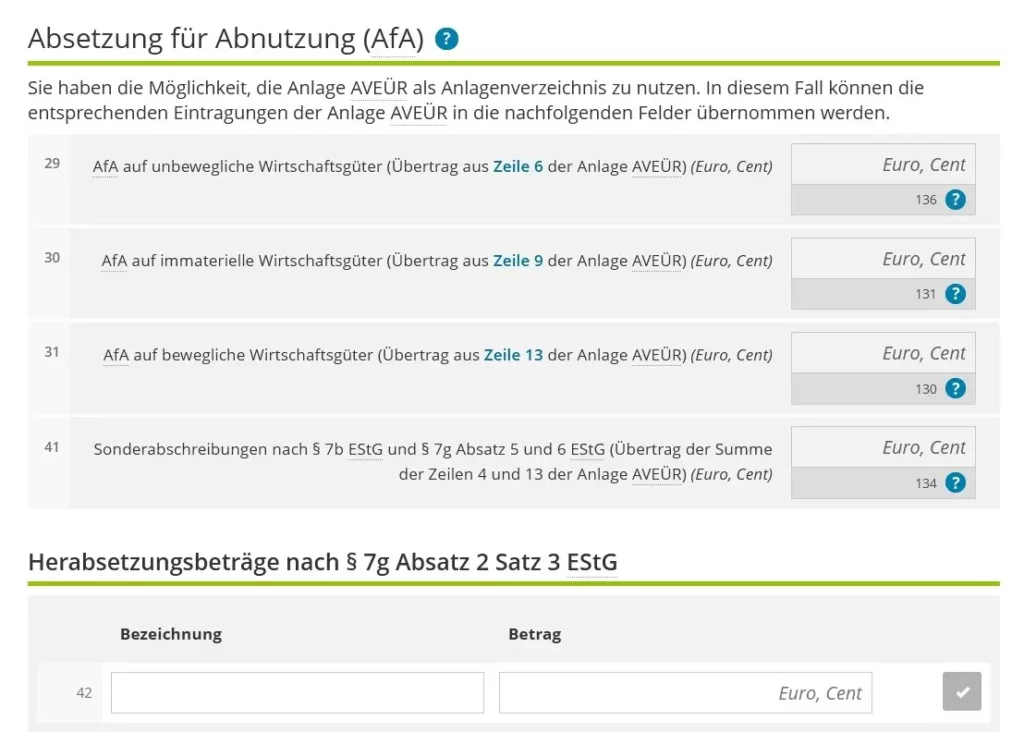

From line 29 – the write-off of expensive assets, that is, those acquisitions for the organization that were above a certain cost and which, because of this, must be written off for several years. The number of years depends on the type of acquisition.

On the write-off of tools, apparatus, furniture, etc. for business purposes

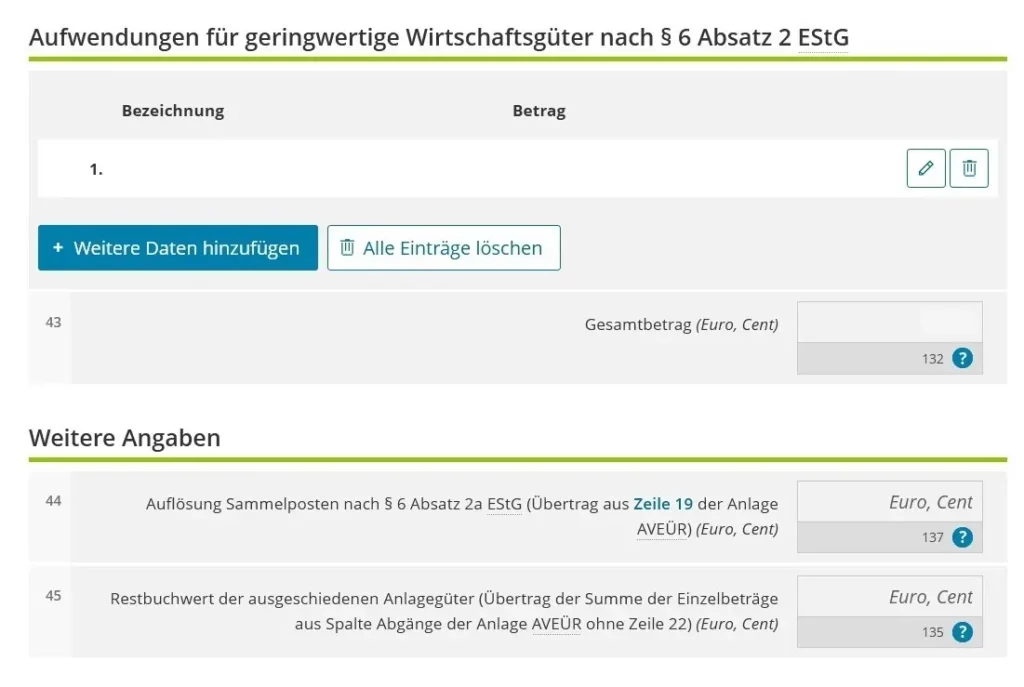

Work purchases up to a net value of EUR 800 are written off immediately in line 43.

The next two lines are again for those who have a lot of assets.

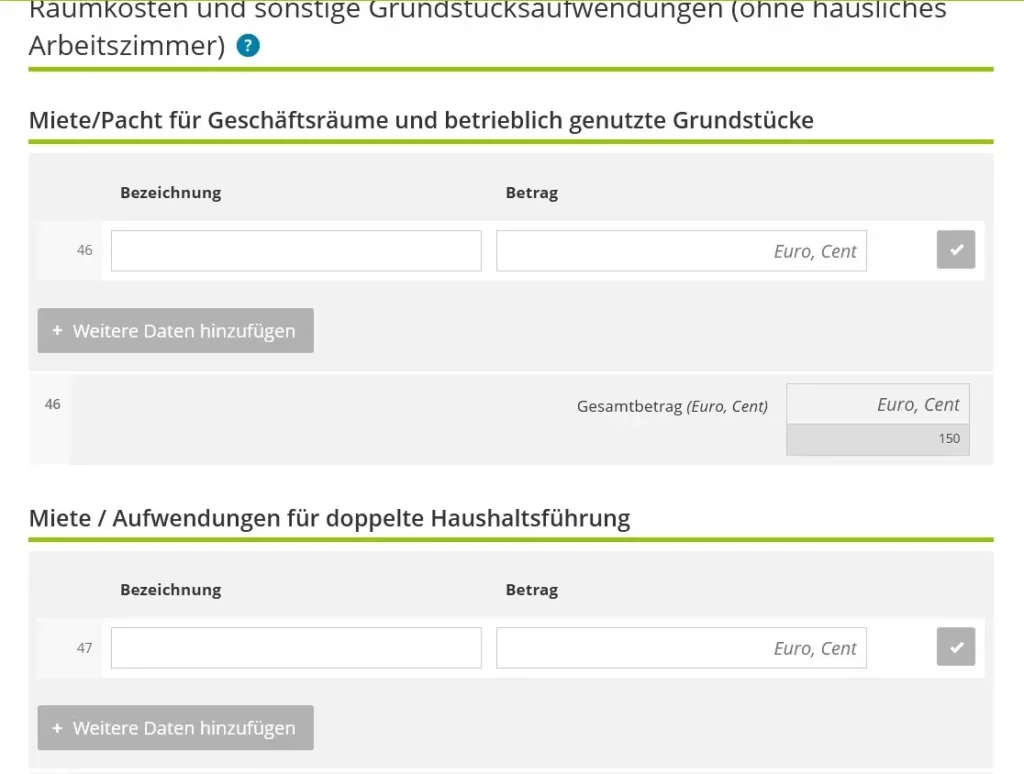

But lines 46 and 47 can be useful for small businesses.

Line 46 – if you are renting a space. You can write the rent (also net for those who pay USt) together with Nebenkosten here.

Line 47 for a double household – the cost of living (rent, repairs, equipment of the house in a minimum amount)

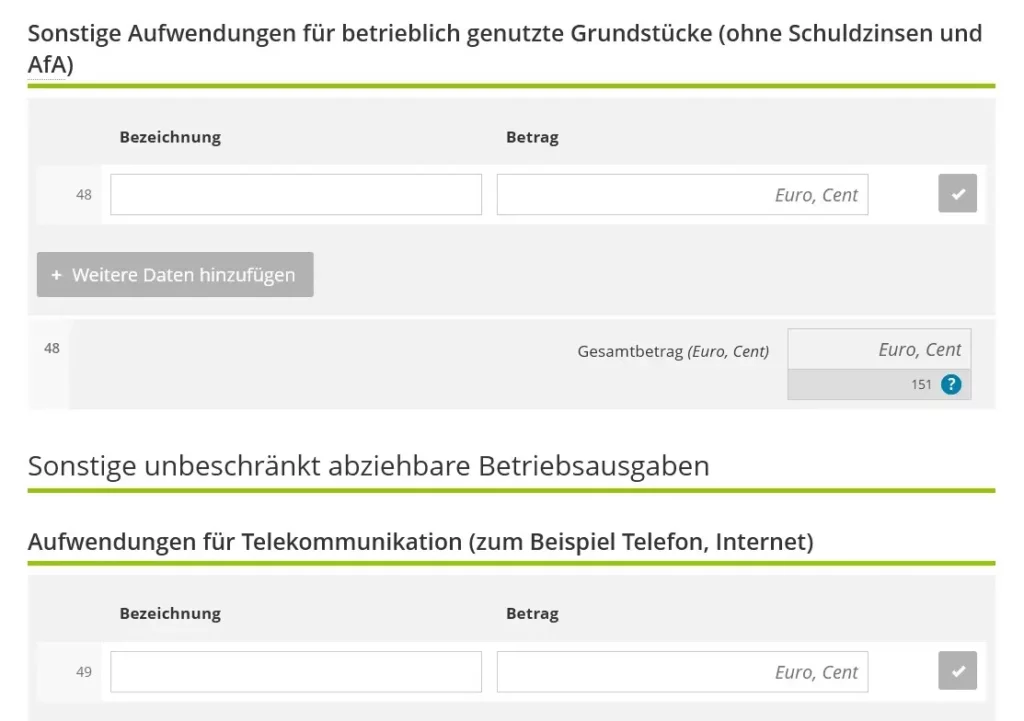

Line 48 Sonstige Aufwendungen are the costs of maintaining the premises owned by the organization (Instandhaltung, Wartung, etc.), but also Grundsteuer, insurance

Other expenses that are written off in full

From line 49, an extensive list of other expenses.

Line 49 – telecommunications costs. To calculate the use of a home network for work, either a lump sum of 20 percent (and no more than 20 euros per month) or documented real expenses are used.

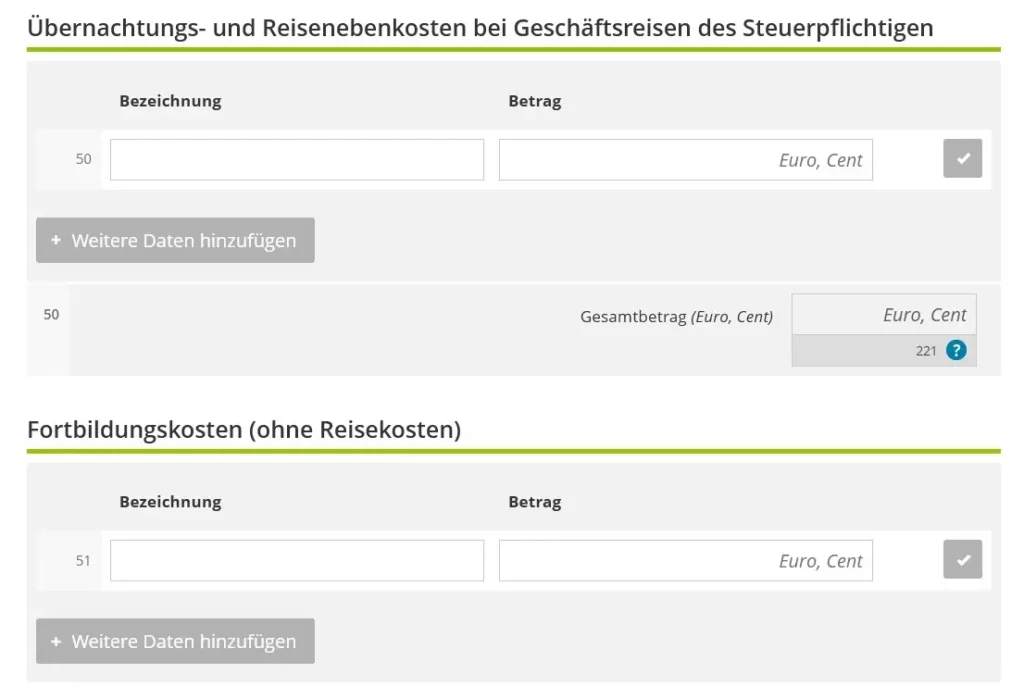

Line 50 – business travel expenses

in addition to accommodation (which is confirmed by checks), business travel expenses include:

- fare payment,

- luggage storage

- autobahn payment,

- ferry payment,

- Parking Fee,

- telephone conversations,

- accident costs,

- entrance tickets to events

If breakfast is included on the hotel bill, it will be deducted as a lump sum (5.60 for Germany, don’t forget to check for the current year)

Line 51 – professional development expenses

Line 52 – legal advice and accounting

Line 53 – rental or leasing of movable property (except for a car)

Line 54 – maintenance (not cars or buildings) and line 55 – insurance and other expenses (not cars or buildings)

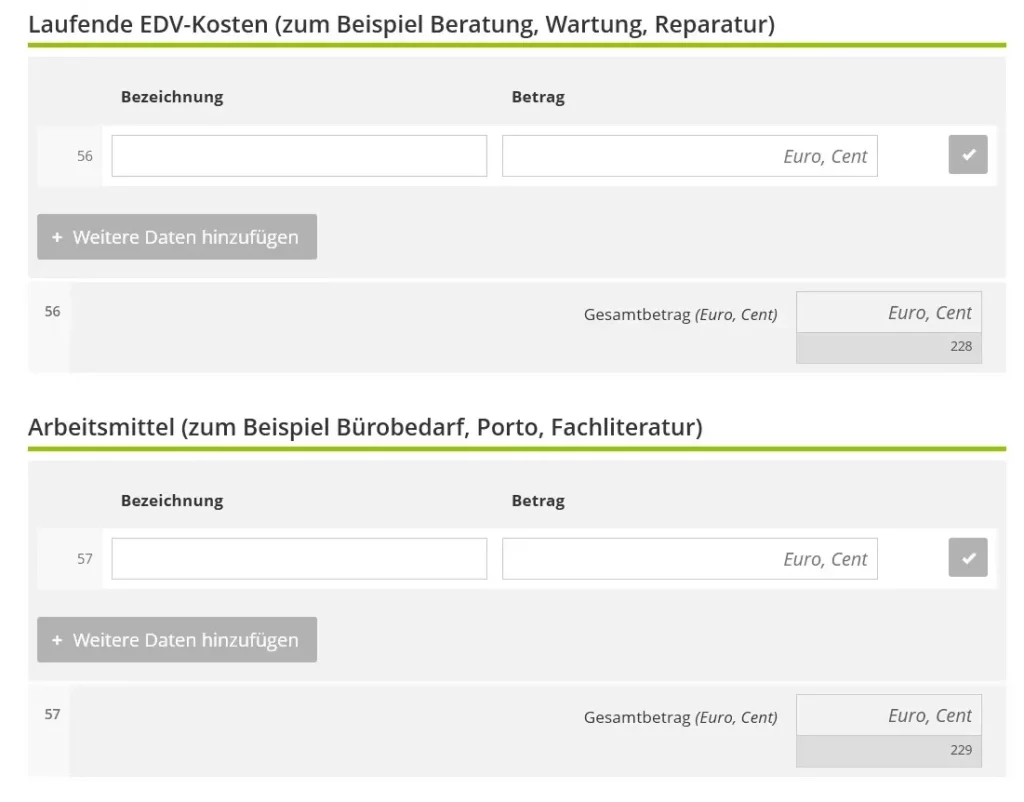

Line 56 – data processing costs (EDV)

Line 57 – small working expenses for office supplies, literature, as well as small tools and apparatus worth no more than 250 euros.

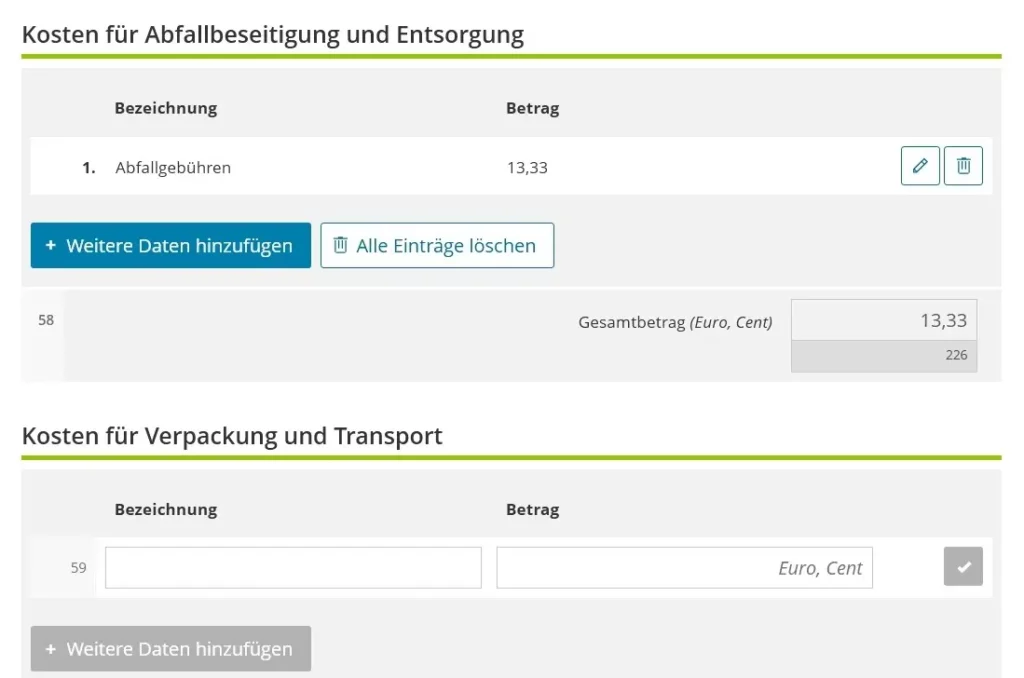

Line 58 – garbage removal

Line 59 – cost of delivery

Line 60 – advertising expenses

Lines 61, 62 – interest on loans taken to buy work equipment

Line 63 – paid Vorsteuer for those who pay Umsatzsteuer

Line 64 – Umsatzsteuer, paid FA

Lines 65, 66 – complex calculations for reserves (not for small businesses)

Other expenses that are partially written off

Line 67 – gifts to partners or clients (up to 35 euros per person per year – fully debited, above 35 euros – not debited). Gifts are also promotional samples of goods or a lottery.

Line 68 – treats on work occasions – 70 percent

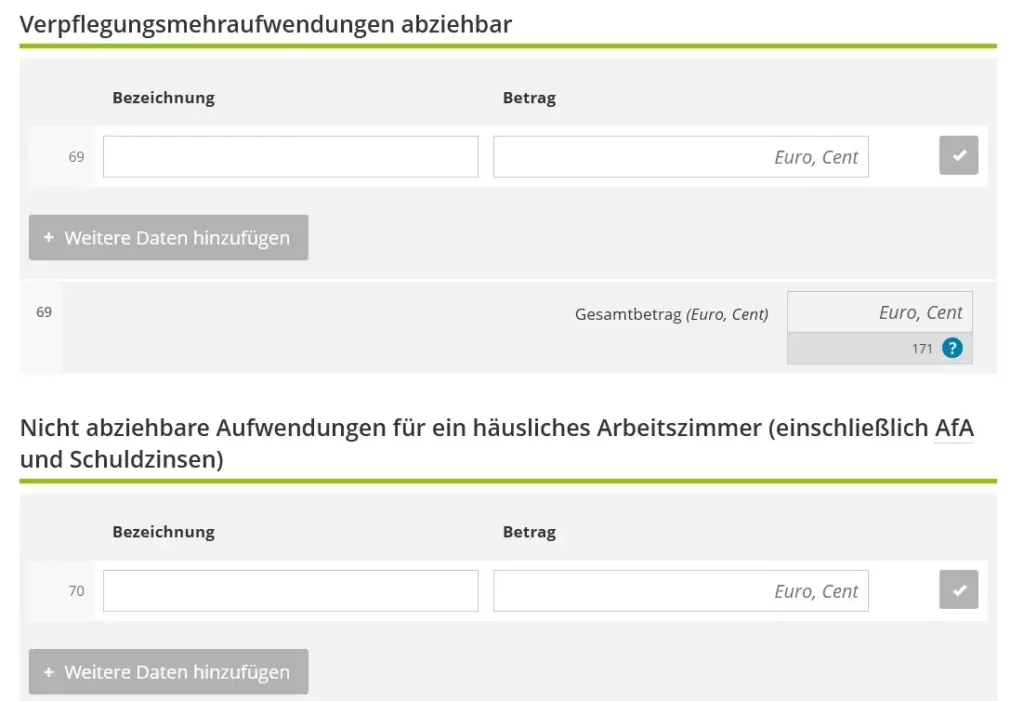

Line 69 – meals on business trips: 14 euros for a partial day, 28 euros for a full day (check each year, the sum can change).

Line 70 – the cost of a work room in the house.

Car and other transportation costs

Car expenses were awarded a separate section.

Line 81 – leasing

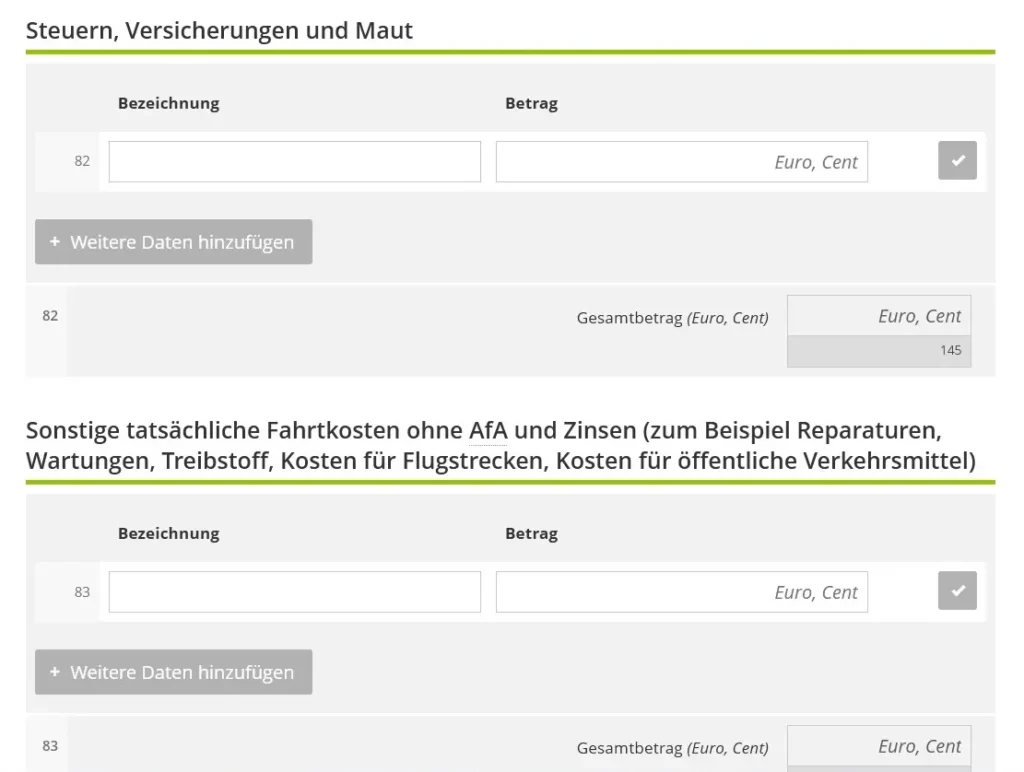

Line 82 – tax, insurance and road toll.

Line 83 – other travel expenses (repairs, fuel, public transport costs)

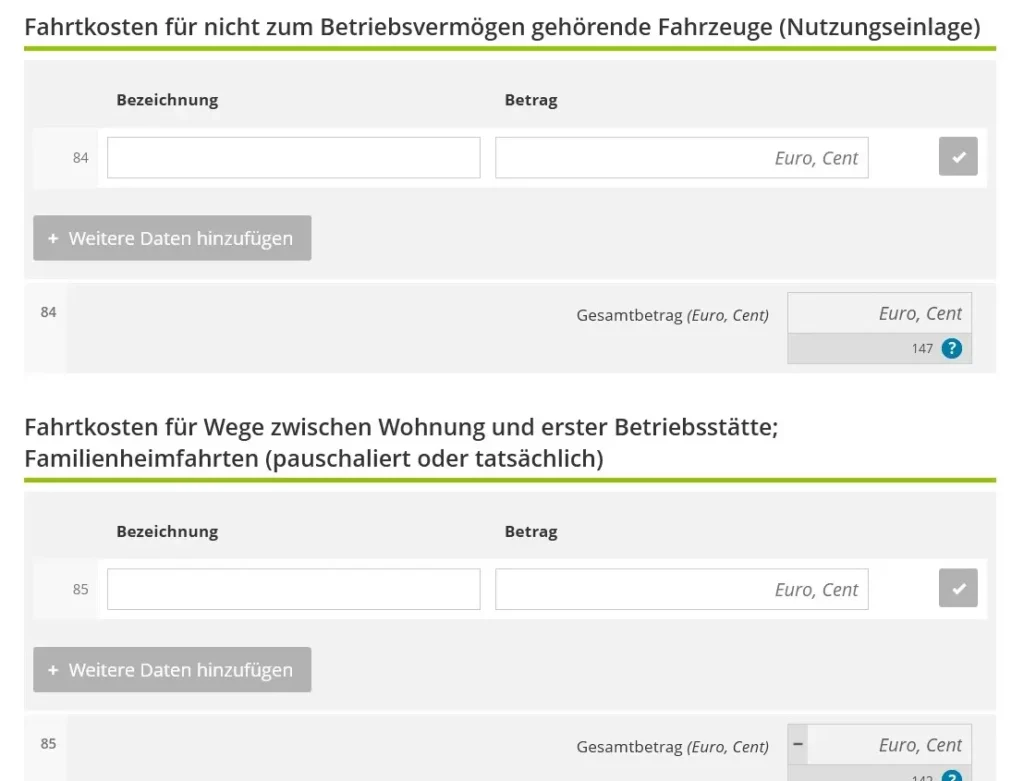

Line 84 for those who use their car for work purposes (30 cents per km).

The distance to the place of work is also taken into account at 30 cents per km, but only in one direction – line 85. This line indicates the actual trips according to the trips journal. These expenses can also be calculated under the 1 percent rule (as well as income from the use of a company car for personal purposes).

Instead of a travel journal, Entfernungspauschale can be used – as for an employee – on line 86.

Non-deductible expenses include, for example, fines, expensive entertainment or gifts for partners, etc.

Profit calculation and additional information

Finally we got to the last section of Anlage EÜR.

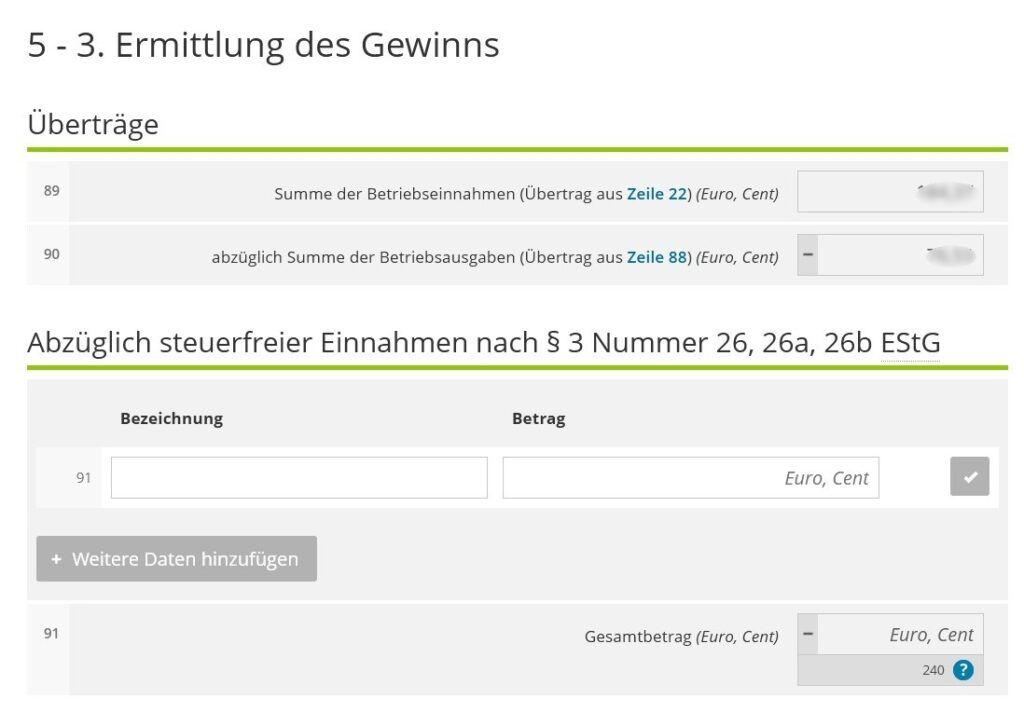

Lines 89 and 90 carried over from previous sections.

Further, income must be reduced by those amounts that are not subject to income tax.

Follow me

Do you have any more questions? Use comments ⇓ or private communication form ⇨

In Line 91 Übungsleiter, Ehrenamtler and Betreuer indicate their paushal.

If above in lines 23-87 expenses were indicated that are correlated with income on line 91, then they should be indicated in line 94

Line 92 sets out other income exempt from this tax (payments from health and care insurance, pension insurance, Mutterschaftsgeld, Arbeitslosengeld, Kurzarbeitergeld and similar payments, Insolvenzgeld, payments to military, police and similar workers for work clothes and other payments related to their service)

Expenses associated with income on line 92 are indicated in line 95.

Lines 93 and 96 are related to restructuring, lines 97-101 – to investments

Line 102 for those who switch from one system to another (from accounting to EÜR and vice versa)

Line 103 for those who have a share in Personengesellschaften

At last, Line 104 – adjusted profit.

Those who had Teilfreistellungen will correct it once more in lines 105 (this is about investment funds) and 106 (this is about dividends).

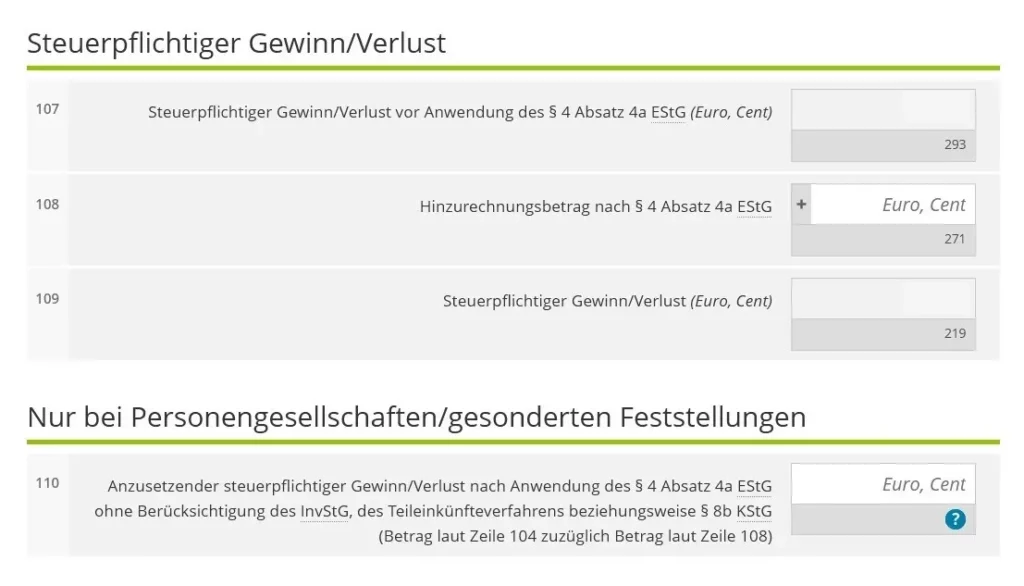

Line 107 – finally that’s all? – you ask. No, the inexorable tax official will say, a little more needs to be corrected.

Line 108 – this is for those who were in debt and Anlage SZ (Schuldzinsen) Line 27, and also for Personengesellschaften.

Finally, line 109 is what we spent three days working for. This data is happily transferred to the tax return – to Anlage G (those who has Gewerbe) or Anlage S (Freiberufler).

Line 110 – for Personengesellschaften

Lines 121-124 – reserves, we don’t need it all.

Ta-dammm! Check!

Oh, and that’s not all. For some reason it writes an error.

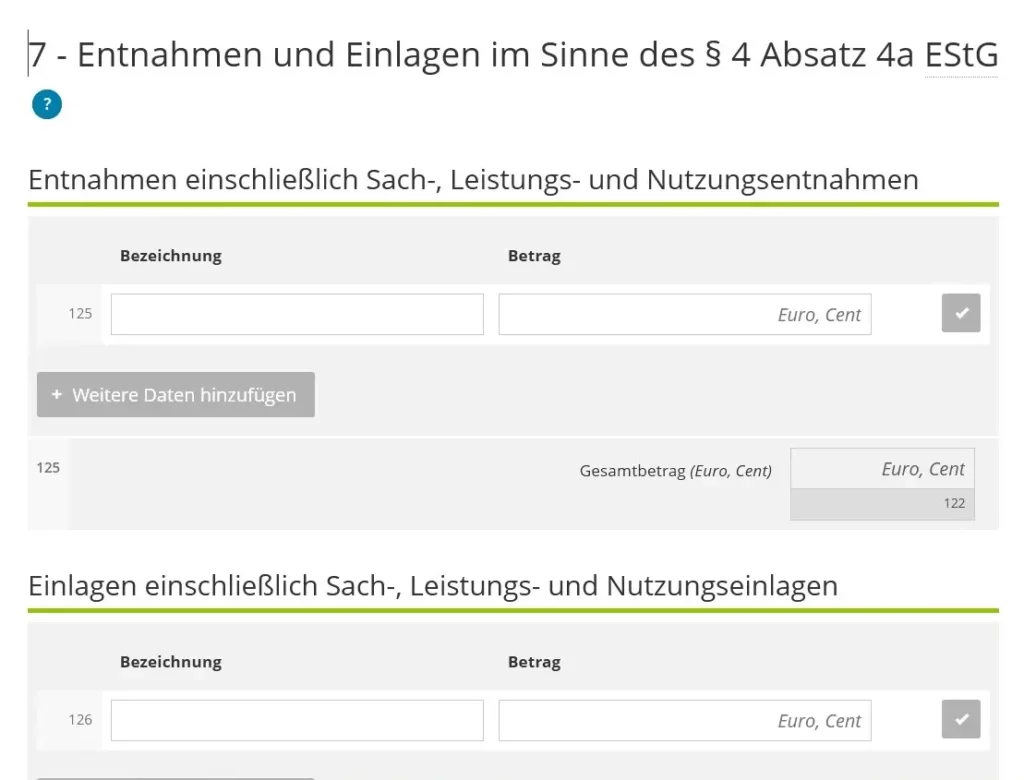

And it writes because of lines 125-126.

I broke my head over this. And what did I come to. Versions met: indicate zero, indicate all income and expenses, indicate the use of business things for personal purposes and vice versa.

My conclusions.

1. The purpose of these lines is initially debts. As well as using personal things for business, business thing for personal. The lines are informative, not for calculation. And if you are an entrepreneur in your sole person, then it turns out that there is practically no border between personal and business.

2. If you have a separate bank account for the organization, then you indicate in this lines personal in business (for example home Internet for business), business in personal (for example car)

3. If you are an individual enterprise and you have only one bank account, then it turns out that all the organization’s income goes to private use, and all expenses come from a private person. That is, all your expenses will be Einlagen (you gave this organization money for expenses) and all your income will be Entnahmen (you took money from the organization).

In conclusion, I want to say. Dear tax officials, I have more and more a feeling that Germany hates small entrepreneurs and they should not have the right to live – either sit on benefits, or have immediately a full-fledged organization with all rather big expenses. Since you forced small businesses to switch from the usual paper Income-Expenses to this application, well, make it understandable to those who cannot afford a tax consultant.

All posts about #tax declaration

All posts about #finance

Do you enjoy the site without cookies and maybe without ads? This means that I work for you at my own expense.

Perhaps you would like to support my work here.

Or Cookie settings change: round sign bottom left

Thank you so much for this! Life-saving for expats!

I am glad, that it was helpful.