Anlage Vorsorgeaufwand is an application of German income tax declaration, where insurances are indicated.

finance

German tax return Elster. Anlage Sonderausgaben

“Special expenses” (Sonderausgaben) used to be in the Mantelbogen of the German tax declaration. Now they have been taken out in a separate application Anlage Sonderausgaben. Lines are in a different order now.

Application content: chirch tax, donations, expenses for first education, maintenance of other persons.

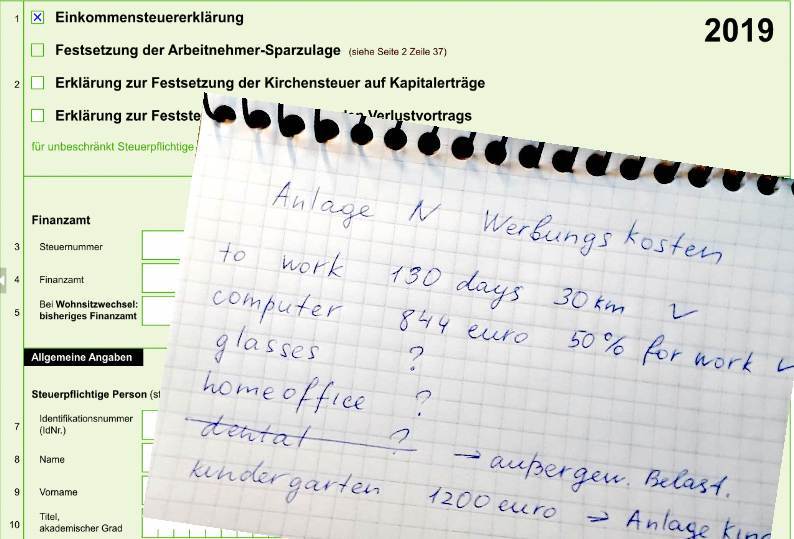

Home office tax deduction in german tax return

Wolf, goats and cabbage – an old task in a new way. How do you combine a fully online high school kid, a part-time elementary school child, a dad in a home office who needs complete silence and not run around rooms, and an 11-month-old baby running around – in three rooms?

Fortunately, the hard work for solution of this difficult logistics challenge will be rewarded. The government allowed to write off days in bedlam home office at 5 euros per day.

More details about how to deduct home office expenses from taxes.

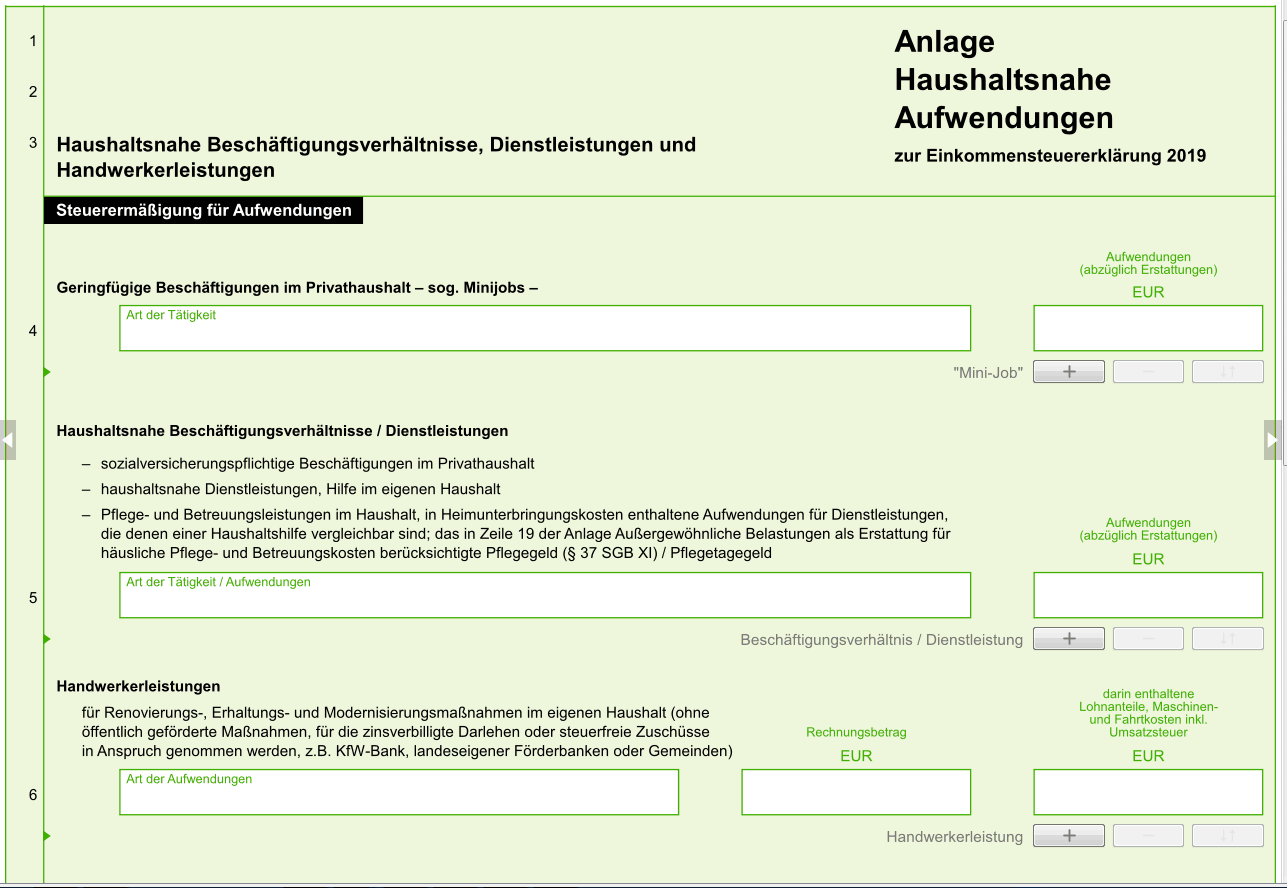

Elster online. 6. Household works deduction – Anlage Haushaltsnahe Aufwendungen (35a)

The landlord or management company have finally bothered to send you an annual calculation? So you can go to the household works deduction in german tax return.

Household works have now a separate Anlage Haushaltsnahe Aufwendungen (35a). It moved here in 2020 from the main part (formerly lines 71-78 Hauptvordruck).

Tax return in Germany. All income tax deduction P-W

Next part of income tax deduction in German tax return, among them the most important – deduction of expenses for work.

Not forget: außergewöhnliche Belastungen (Exceptional costs) are deducted, if they over individual limit.

How to calculate the limit of außergewöhnliche Belastungen read here

Other parts: A-D, E-H, I-N

German tax refund – What I can claim to return. I-N

Futher with all German tax deductible expenses. Not forget: außergewöhnliche Belastungen (Exceptional costs) are deducted, if they over individual limit.

How to calculate the limit of außergewöhnliche Belastungen read here

Other parts: A-D, E-H, P-W

How to fill German income tax declaration – #steuererklaerung

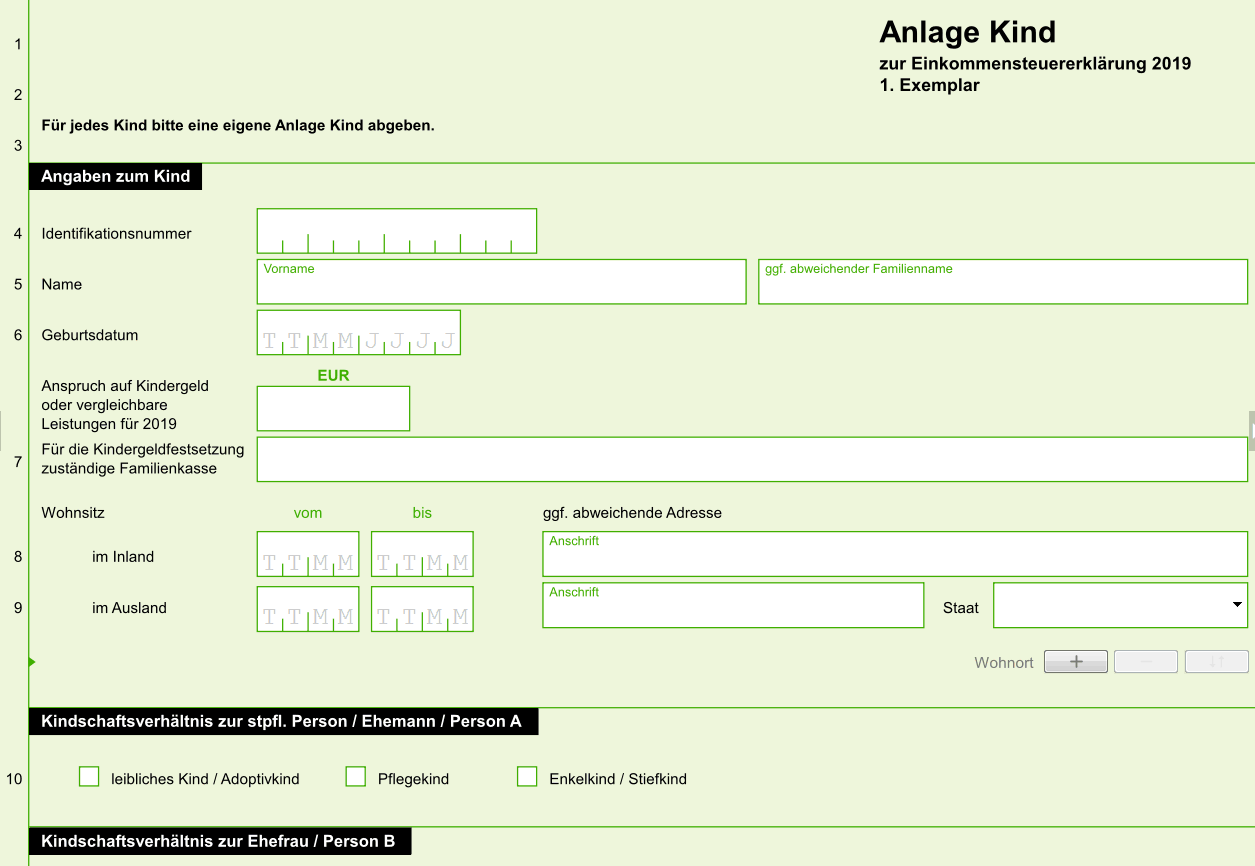

German tax return. Elster online. Anlage Kind

We go to the Anlage Kind. Anlage Kind – application for expenses for children in German tax return: Kindergarten, education (Ausbildung), Kindergeld and Kinderbonus.

Anlage opens if you mark it in Anlagenauswahl page.

All tax deductions (in German income tax declaration). E-H

In this post all tax deductions from E to H – from Education to Houskeeping Help.

Not forget: außergewöhnliche Belastungen (Exceptional costs) are deducted, if they over individual limit.

How to calculate the limit of außergewöhnliche Belastungen read here.

Other parts – A-D, I-N, P-W,

Other posts about german tax return – #steuererklaerung

All income tax deduction (in German tax return). A-D

From A as Additional education to D as Dysgraphia, dyslexia – all income tax deduction in German tax return.

If I write “is as außergewöhnliche Belastungen (Exceptional costs) deducted”, it means that this expenses are deducted only if they over individual limit.

How to calculate the limit of außergewöhnliche Belastungen read here

Other parts: E-H, I-N, P-W

All deductible expenses in German tax return. 1. Außergewöhnliche Belastungen

When I ask those who already understand something in German and have lived in Germany for more than one year why they prefer to pay a tax consultant instead of filling out a tax return on their own, I am told that

1. there are no previous tax return as a sample and

2. they never know what deductible expenses there are – what if they miss out on some possible returns?

As answer on the second point, I decided to collect all possible deductible expenses in Germany.

But there is one thing, that you must know before we begin with the list: many of these expenses can be deducted only if they cross a certain border, and this border is rather big. This border is named Außergewöhliche Belastungen.