Last Updated on September 9, 2023

The Grundsteuererklärung real estate declaration in Germany, although it took a long time to prepare, does not have good explanations with examples. It took me two weeks to fill out, understand and order the papers.

If you haven’t started filing a real estate declaration yet, do it now. The time is already approaching the middle. The declaration must be submitted by everyone who owns real estate (apartment, house, garage – in whole or in part). Even apartment owners own some land (Grundstück).

What is selbstständig, Unternehmer, Honorar, Firma in Germany

Joint building ventury (Baugemeinschaft)

Homeowners association in Germany

Fighting condensation and mold in Germany

German income tax declaration. Anlage N-Aus

I am not a tax consultant and am not responsible for the content of your declaration.

Each land has its own data requirements, but the main points remain the same for all. I have Baden-Württemberg. I consider the declaration from the point of view of an ordinary owner of apartment, not an investor and not an entrepreneur. Links to official comments on the federal states – in part one Summer surprise. Real estate declaration in Germany.

Real estate declaration in Germany 2022 – deadline and what you need to fill out

The submission deadline is Januar 31st.

You can only apply through Elster, so at the very least you need an Elster account. If you have a joint family account (that is, an account for one of the partners through which the family declaration is sent), then, as experience shows, you can send from it. A new account is made within 2 weeks.

The second thing you need is a property tax notice from your Gemeinde. Separately or together with this paper, you should have been sent a reminder to fill out a declaration of real estate Grundsteuererklärung. In this / these notices you need the Aktenzeichen number and the designation of the address of the property.

The third paper is Ausdruck aus dem Grundbuch (an extract from the real estate register). If you bought housing under construction, then you may only have the first statement upon purchase, where the developer is indicated as the owner, and you are indicated as the purchaser. In this case, it is advisable to order a new statement (10 euros, 1 week minimum when ordering online). For condominiums with an underground garage, this will most likely be two papers. You can order paper from Grundbuchamt or online (for example, Baden-Württemberg).

You should also have your Tax Number and Identification Number on hand. You provide this information on your tax return.

Filling out a real estate declaration Grundsteuererklärung

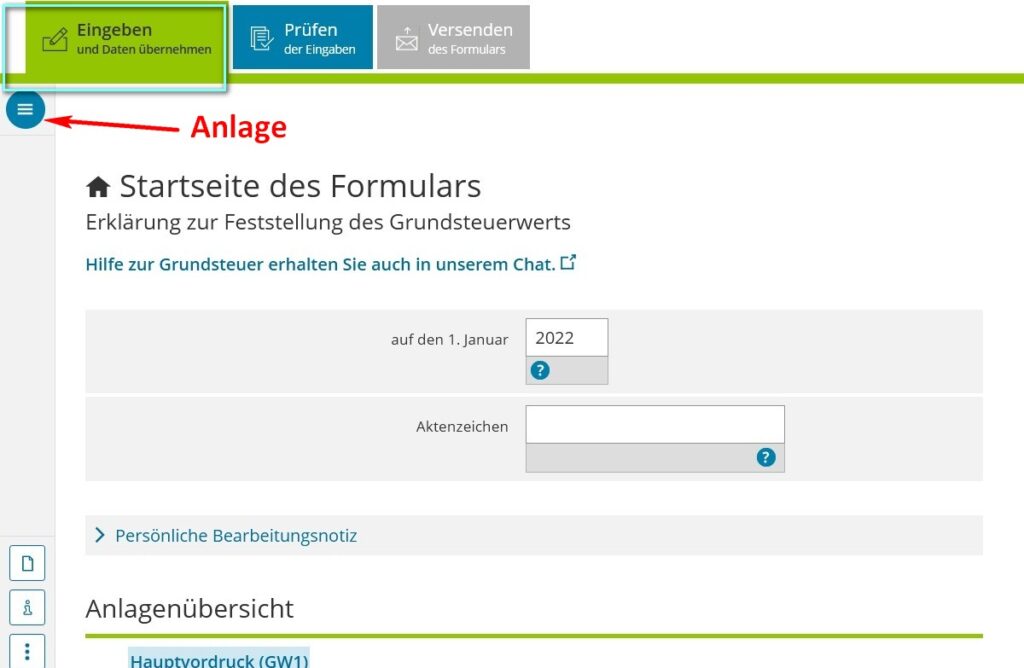

At the very beginning, you can easily skip the preliminary page, which indicates the document number for the taxation (Aktenzeichen) of your property. Don’t worry, you can come back to it later. You will still need to add an attachment to the declaration anyway.

In order to return, you need to press the green button. On the start page, you need to indicate the year 2022 and Aktenzeichen number, which you will find in the paper from your Gemeinde. If you somehow pay property tax, but have no idea where the documents for it are, you will have to go to the town hall.

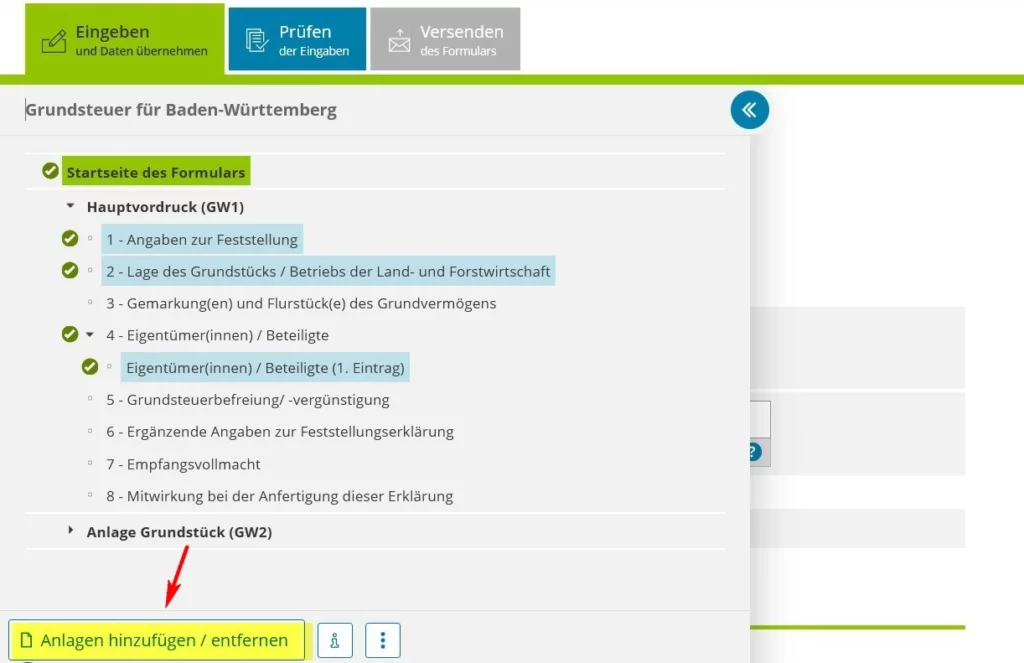

Next, click on the three stripes in the blue circle and select Anlagen hinzufügen. This can be done at any other time.

The application that homeowners need is called Anlage Grundstück (GW2).

The main part of the property declaration Grundsteuererklärung – Hauptvordruck

As in the income declaration, the main part is called the Hauptvordruck. Here we indicate what we own and who owns.

A property that consists of several parts, such as an apartment and a garage, will be considered as a whole if they are used as a whole.

The first question that interests the tax authorities is: why did you need to bother them and submit this declaration. Unfortunately, there is no answer “because you want to increase the property tax”, you have to choose Hauptfestellung and Grundstück.

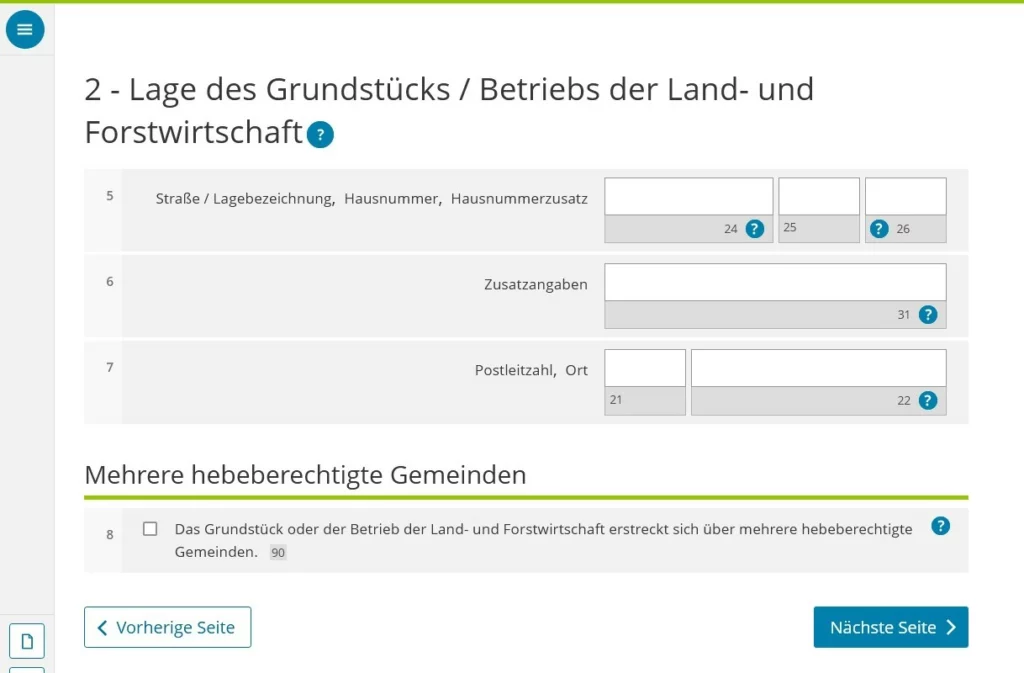

The next important point is the location of your property. Street, house and letters at the house number, if any.

Line 6 Zusatzangaben – the number of the apartment in the internal papers and the number of the place in the garage. You can write this off from the tax paper received from the town hall, because there is often no official apartment number in Germany. For example, our apartment is numbered 1.3 because the developer called the house number 1, although the address is completely different and the house was the 6th out of eight in the development order. Where they counted the apartments from, it remained a mystery to me in general – no one will find it by this number, since no one knows who has what numbers.

Line 8 is unlikely for you. Then you need to have the one property in different cities.

Section 3. Real estate data from Grundbuch

The following lines will probably cause you questions, as they require the decryption of entries in Grundbuch.

If you live in an apartment, you will most likely need to make several entries in Section 3. This is precisely what raises questions among those who live in condominiums: Grundbuch contains some data that somehow has little to do with you and what it is completely incomprehensible to indicate.

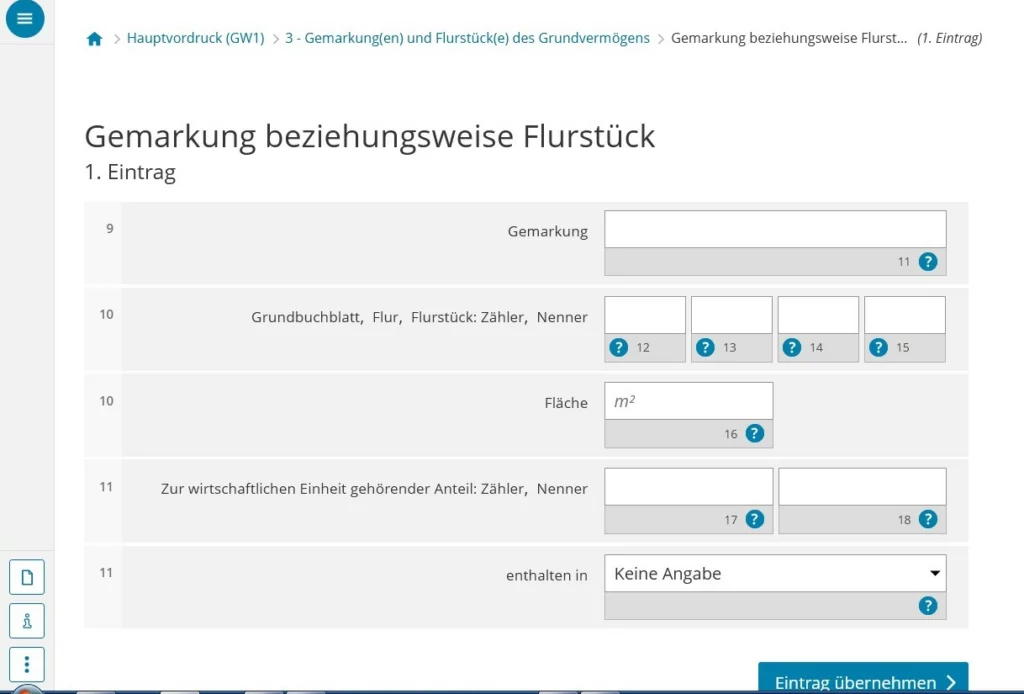

So, you clicked on the blue button Weitere Daten hinzufügen and you see this picture.

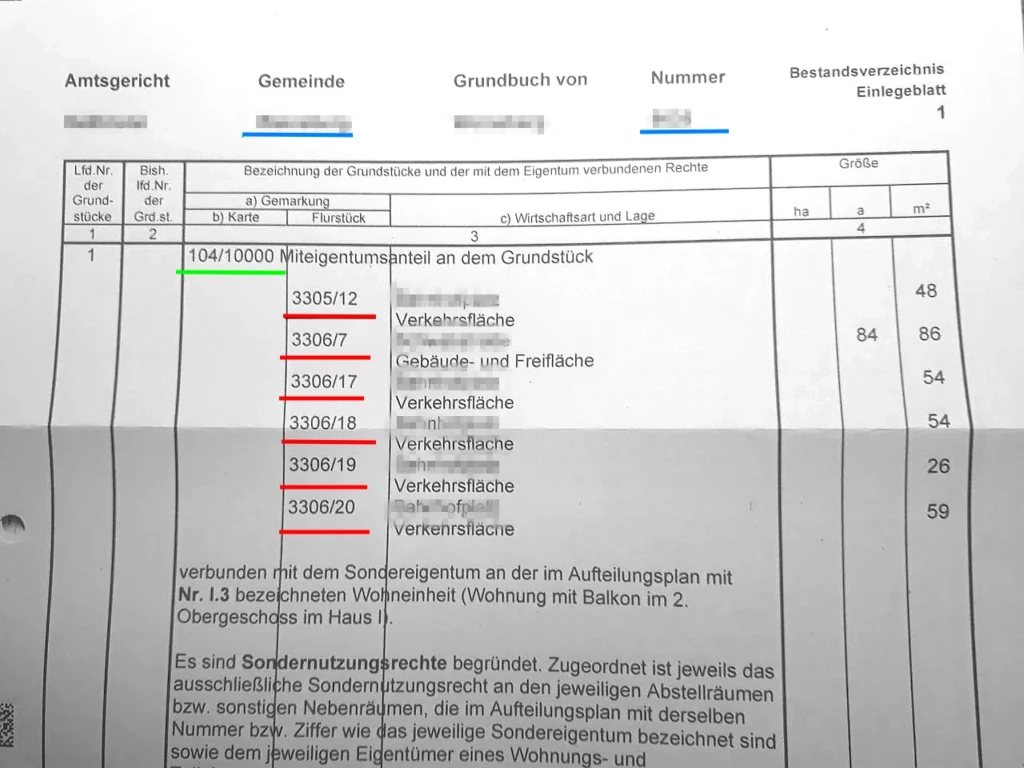

We open our extract from Grundbuch. We will need the very first page where the table begins. This is where it is indicated which section is in question. Further – change of ownership, changes in Grundbuch, encumbrance with debts or the obligation to carry out modernization, etc. All this is very interesting, but not for the real estate declaration.

Here I see six entries. They all belong to one large residential complex of 8 houses and I list them all in separate Eintrag.

Line 9 Gemarkung – this is the Gemeinde where we own housing. Highlighted in blue. Sometimes the name is repeated below, before indicating the site.

Line 12 Grundbuchblatt – Nummer, underlined in blue. You will need to order this number from the Grundbuchamt if you already have a similar outdated extract. The number is also indicated on the title page of the extract.

Line 13 Flur – in Baden-Württemberg almost always absent, in other lands there is. If there is something in the Flur column, you indicate it. If not, then no, and ignore the yellow warning, which will now pop up all the time.

The Flurstück number (underlined in red) consists of two parts: Zähler (numerator) and Nenner (denominator). So I write: line 14 – 3305, line 15 – 12.

Line 16 Fläche – enter the appropriate number. Flurstück 3305/12 has an area of 48 square meters.

Lines 17 and 18 – how much belongs to me from this area. Underlined in green: line 17 – 104, line 18 – 10000.

Line 11 enthalten in – here I choose 1 because all my Flurstück belong to the same Bodenrichtwerte zone, and are not scattered in different zones. We will reach the zones in the application.

Click Eintrag übernehmen.

Repeat for the next entry 3306/7 in my case. The dimensions are interesting here. Let ha, a do not bother you. a is 100 sq. m, that is, the figure will be the same as if you simply write off everything in a row:

84 a + 86 sq. m = 84 * 100 sq m + 86 sq m = 8486 sq m. I write in line 16 – 8486.

I entered all six Flurstück, but the fun didn’t end there because there’s also a garage that has its own Grundbuch page and all the same Flurstück, only with a share of 1 to 10,000 and other Grundbuch nummer. Six more entries.

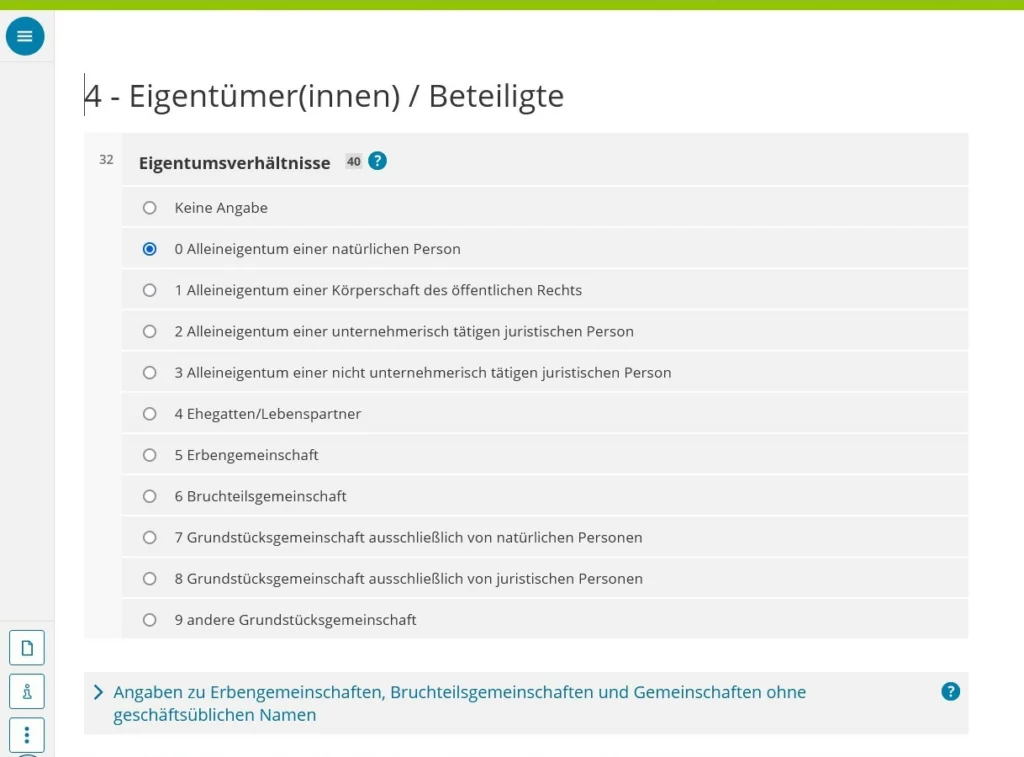

Section 4. Owner/s

You need to specify the property type. The usual owner is interested in the lines:

0 – sole property of an individual

4 – spouses, partners

5 – heirs

6 – fractional ownership indicated in Grundbuch. This is not co-ownership in a condominium. In case of Bruchteilsgemeinschaft, all share owners must be listed.

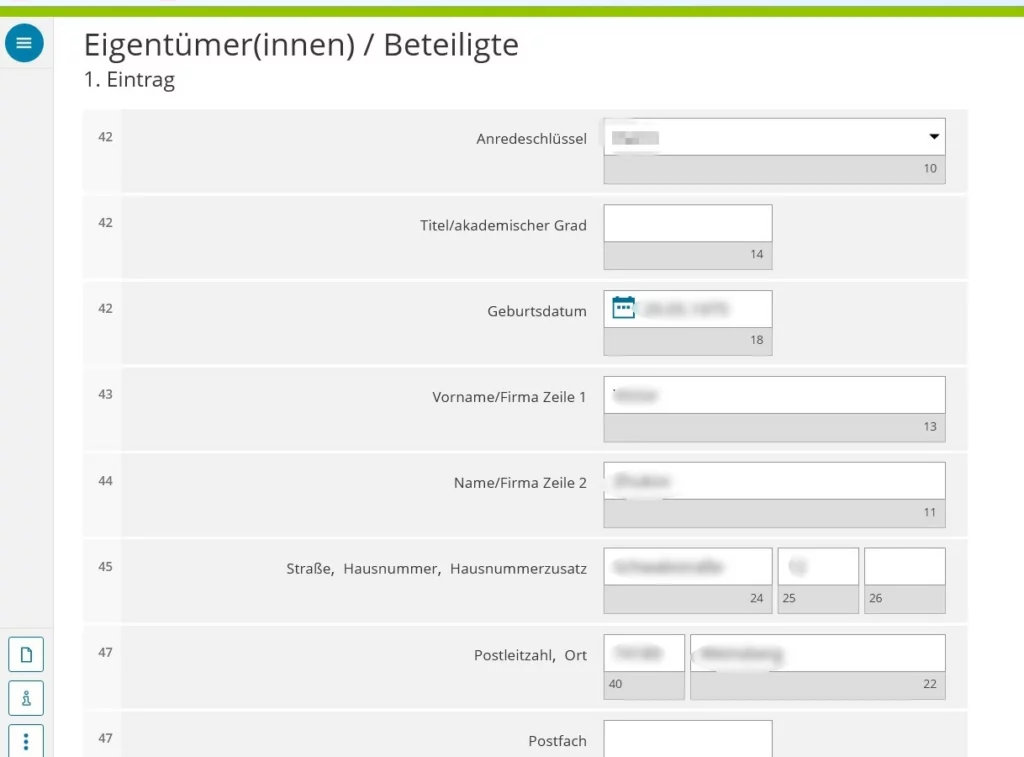

Specify the first (or only) owner. Lines 42-47 are clear.

Lines 48 only for those who live abroad.

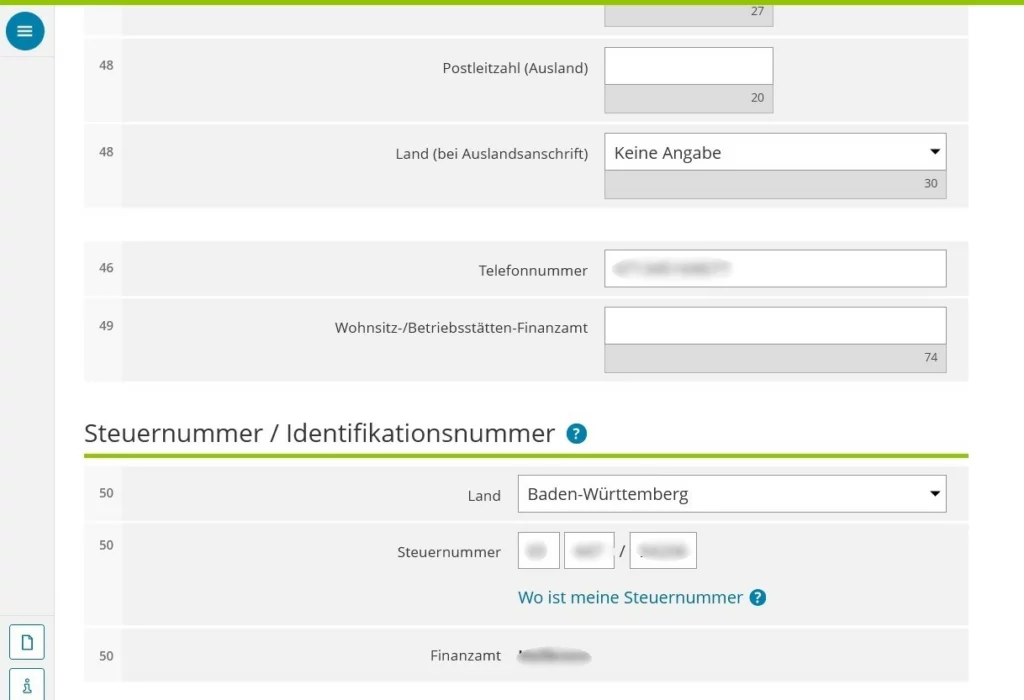

Line 49 – Finanzamt at the place of residence.

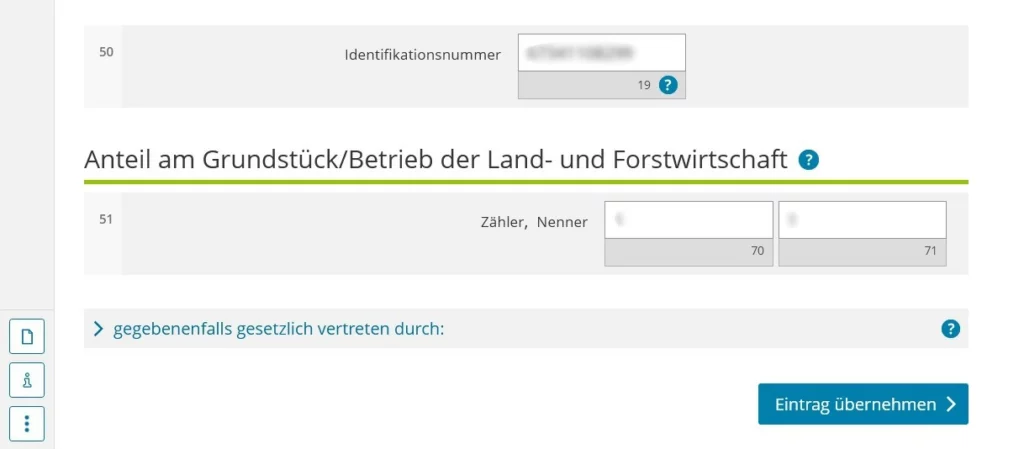

The most interesting line here is line 51. The sole owner indicates 1 and 1. Spouses with equal shares – 1 and 2 each (that is, 1/2). That is, these data refer to shares between the owners of the apartment (you own the apartment in half), and not to the share of your apartment in a large plot (104 to 10,000 in my case).

Repeat for other owners.

Section 5 – for those who have tax credits or exemptions.

Section 6 – additional data for very special cases.

Section 7 – a trusted person who submits this real estate declaration for you (for example, a tax consultant). In the case of shared ownership by several people, you need to choose one who will provide data for all.

Section 8 – data of the tax consultant, if he helped in filling out.

Application Anlage Grundstück

Open the Anlage Grundstück GW2 application. Here in different federal states there are discrepancies in the amount of data indicated. In Baden-Württemberg, everything is greatly shortened. In other states, they also ask for the type of housing, the year of construction, major repairs, the number of meters, etc. View help in Elster (upper right corner).

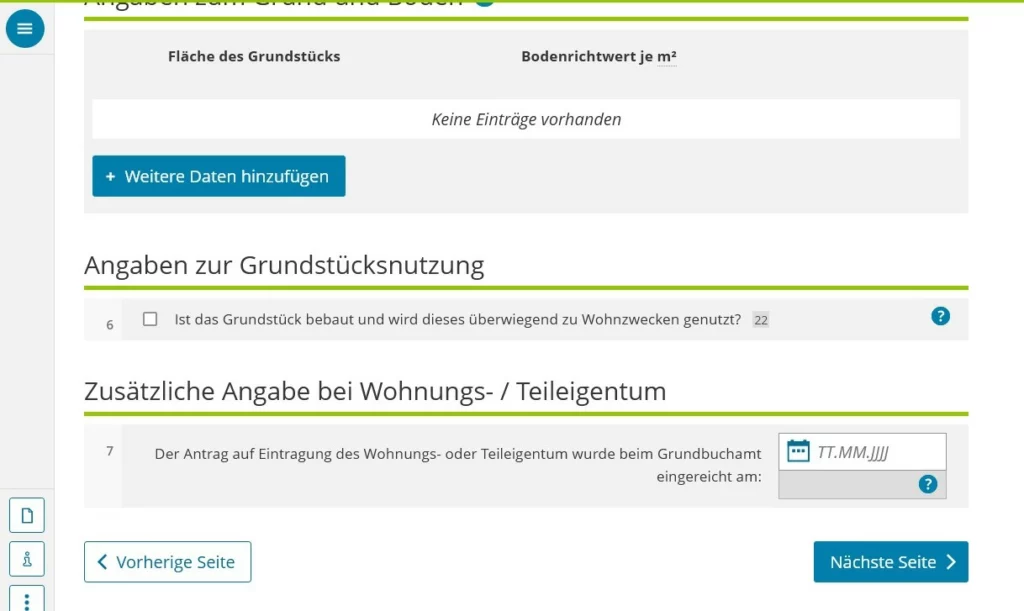

Before we enter the data Angaben zum Grund und Boden in the Weitere Daten hinzufügen, we note that our property has been developed and is used for housing – line 6.

Line 7 – as written in the Help, if the site was acquired before January 1, 2022, then for simplicity, we indicate January 1, 2022. Apparently, so that people do not get confused in different records. Even new housing already has several entries in Grundbuch (purchase by the developer, purchase of the apartment, ownership of the apartment).

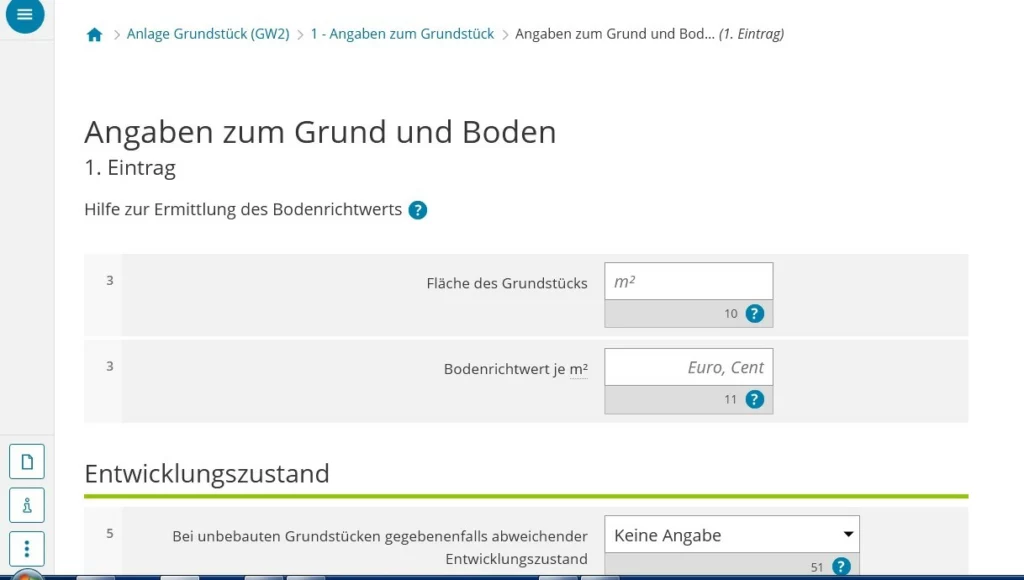

And now we indicate the data of Angaben zum Grund und Boden. At this point, my brain is not only boiled, but already boiled away, so I’m not very sure that I filled everything in correctly.

Since several Fflurstück by me belong to the same complex and all together to the same zone in terms of land value, I sum up all the square meters and calculate my share in them.

That is, in my case it will be 8486 + 59 + 26 + 54 + 54 + 48 sq m = 8727 sq m * 105 (104 + 1) / 10,000 = 92 (rounded).

That is, Fläche, I write 92 sq. m.

I doubt the correctness because the tax that we pay, if I, again, correctly counted, is derived from the figure of 99 square meters. Although, perhaps, there is simply some kind of additional fee.

Bodenrichtenwert per square meter we look at the link that is indicated for your federal state in the Help (click symbol right oben).

In Baden-Württemberg it looks like this. If you can’t find all the small areas, just zoom in, they gradually pop up. The red lines indicate areas of the same cost, the blue figure is the cost per square meter.

Line 5 is not relevant in our case, we leave it.

Section 2 applies to the inheritance of the right to build on the site.

Successful filling to all those sentenced to it.

Other posts about #buy real estate in Germany

#tax in Germany

Do you enjoy the site without cookies and maybe without ads? This means that I work for you at my own expense.

Perhaps you would like to support my work here.

Or Cookie settings change: round sign bottom left